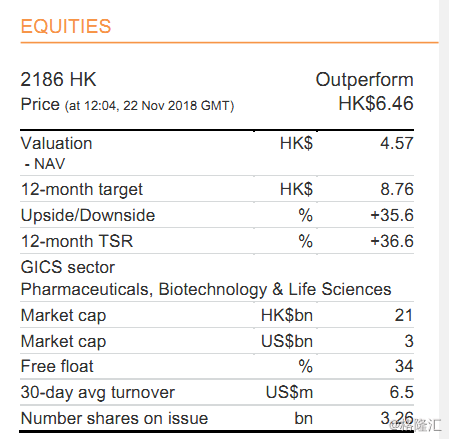

机构:麦格理

评级:买入

目标价:HK$8.76

Enjoying mild price decline

The blockbuster drug of Luye Pharma Group (LUYE), Lipusu, should contribute 38% of revenue and 63% of profit in 2018, according to our estimates. It has stayed out of the National Reimbursement Drug List (NRDL) to avoid severe price cuts of 30-50%. However, we believe it does need to negotiate to enter provincial drug lists (10 provinces so far) and yield some price discounts on an annual basis. The price drop should be much milder than the cuts required by NRDL tendering, in our view. Factoring in such gradual price drop, we expect sales growth of 15% and 13% in 2018 and 2019, which will peak in 2023 at Rmb2.5bn. Including all competing forms of paclitaxel (active ingredient of Lipusu) on the market, Lipusu accounts for 35% of share by value and 18% by volume.

Plan B ready

We are confident in our growth forecast for Lipusu in 2019 as it has escaped both the NRDL tendering and the recent (likely the next) round of 4+7 centralized procurement. However, projection beyond 2020 is less certain and management has a plan B in place to offset any potential shortfall from Lipusu. The company purchased Seroquel regular and extended-release tablet from AstraZeneca in June for US$546m, payable in 3 instalments over 2 years. We expect this and another two products acquired in 2017 (from Acino for €245m) to contribute 22% of revenue in 2020. New products under development should also start contributing after 2020, reducing the company’s revenue dependence on Lipusu.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员