机构:德意志银行

评级:买入

目标价:61港元

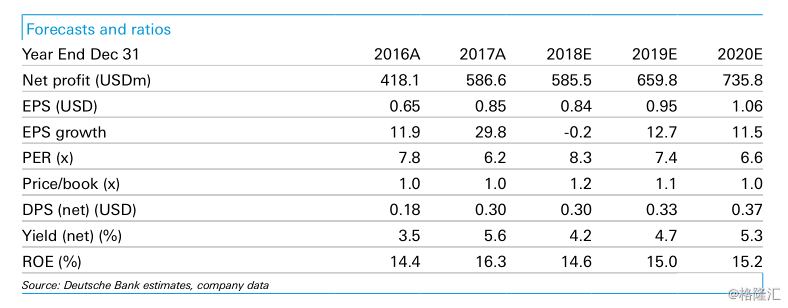

An outperformer this year with a defensive business & USD assets BOC Aviation (BOCA) stock rose 33% YTD (vs. HSI down 15%), thanks to a highly visible business model with a diversified global footprint, continuing strong aircraft/air traffic demand, and 100% USD assets/revenue to hedge against RMB weakness (see report: A defensive play amid market turbulence ). We met management today for a company update. Despite the recent stock pullback with concerns around expansion slowdown in 3Q18 (6 aircraft deliveries this year deferred into 1H19), management is still pushing for a US$4bn full year Capex target and expects 2019 to be a record year in terms of aircraft deliveries. The stock is trading at 1.2x 2018E P/B vs 15% ROE and ~5% dividend yield. Buy rating maintained.3Q18 operating data highlights & management meeting takeaways

■Aircraft fleet number (down 1 qoq): Total owned fleet was 294, down 1 from 2Q18 with 8 deliveries and 9 aircraft sales during the third quarter.

See Figure 1.

■ Aircraft delivery pipeline (16 in 4Q18) and Capex: 52 total deliveries scheduled in 2018 so far (36 deliveried) with 6 scheduled earlier deferring into 1H19 due to ongoing engine supply issues. This posts downside risks to US$4bn full year Capex target (vs. US$3.5bn committed Capex as of 2Q18 for 58 deliveries and this number has been reduced in 3Q18 from our understanding). Anyway, management still looks for double digit aircraft NBV growth for the full year, and expects 72 total deliveries in 2019, being a record year in company history (71 in 2016).

■PLB deals (no additions in 3Q18): We have not seen new purchase-and-lease back (PLB) deals added for 2H18 so far and management explained airlines usually look for PLB agreements 12-18 months beforehand (BOCA added PLBs for 2019). Management does see PLB deals and overall leasing demand to increase in a rate hike/tightening cycle and a higher oil price may trigger early retirement of less oil efficient aircraft models (i.e. more replacement demand).

■ Widebody exposure remained healthy and management sees weakness in older widebody aircraft models for which it does not have any on balance sheet.

■ Net lease yield: management is confident to maintain a stable net yield (8.5% in 1H18) with a strong funding advantage and abilities to pass through a rate hike impact to airline customers. BOCA just did its largest unsecured syndicated loan of US$750mn in October (size up from US $500mn due to strong demand), with a floating rate spread narrowed from similar lending facilities 2 years ago.

■ Average aircraft age remained young at 3.1 years with 8.2 years average remaining lease term. Aircraft utilization remained 100%.

■ Geographical exposure is limited to India, Turkey and other weak currency EM countries. In fact, for Turkish Airlines (top 10 customer of BOCA), it is a beneficiary of weakening local currency as most of its revenue is from International routes.

■ Leverage target and payout: it still targets 3.5x-4.0x debt to equity leverage, up from 2.9x in 1H18. It commits to 35% annual payout ratio.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员