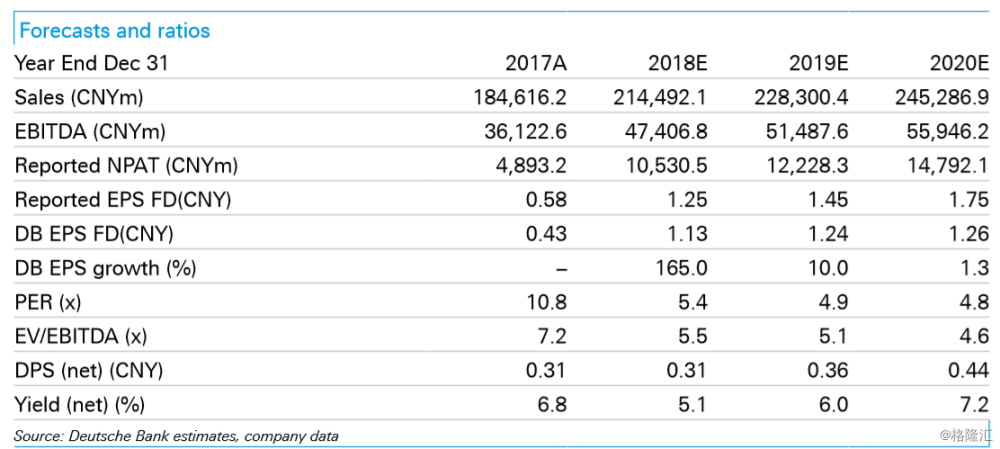

机构:德意志银行

评级:买入

目标价:11.49港元

Deleveraging to be accelerated in 2H18

In 1H18, investors were disappointed that CNBM did not deleverage, as they had spent RMB10.5bn in capex with c.RMB400m used to consolidate their holdings in South Cement and SW Cement. However, deleveraging will speed up in 2H with CNBM repaying c.RMB4bn in debt by end Sep while total debt repayment will exceed RMB10bn for the full year. CNBM emphasized that they will strictly control capex, keeping it under RMB19bn for the full year. In 2019, CNBM expects capex to be c.RMB15bn and less going forward, so the strong operating cash flow of CNBM, c.RMB20bn in 2018 by our estimates, would allow CNBM to repay at least RMB10-15bn of debt each year. This excludes other means to reduce debt, such as using debt to equity swap, restructuring of its business for listing on Ashares and disposal of assets. In June, CNBM netted RMB200m for disposing of a land plot in Zhejiang province, formerly where their cement plant was situated. Other land sales in Jiande city and Changxing city are also in the pipeline and could be completed by the end of 2018. CNBM is also working hard to deliver a working plan for its restructuring and will announce once ready.

No slowdown in 3Q slow season, profitability ahead of expectations

CNBM’s 1H18 sales volume declined by 5.9% yoy (170mt to 160mt) but sales have picked up since and should be on track to meet c.360mt of sales for the full year, down 2.8% yoy. In Sep, daily output averaged 1.03mt/d, which is 25.6% higher than last Sep. By the end of August, CNBM’s ASP was c.RMB9/t higher than that of 1H18 with CNBM confident that ASP would be at least RMB20/t higher HoH. According to data up to Sep 10, spot ASP for its key subsidiaries has increased nicely, such as South Cement with ASP of RMB346/t (1H18 ASP of RMB325/t) and SW Cement with ASP of RMB314/t (RMB288/t in 1H18). CNBM believes costs will be higher in 2H due to higher transportation and coal costs, though we do not necessarily believe that’s the case. Overall, DB expects CNBM’s GP/t to improve by RMB19/t HoH to RMB125/t (vs 1H18 GP/t of RMB106/t).

Concrete profitability turnaround very sustainable

1H18 concrete business margins were solid, improving by 3ppts yoy in 1H18 and will remain strong for 2H18. CNBM is primed to gain market share over its peers as they have cement and, in particular, aggregates, which are in short supply currently. While there is room to raise concrete prices further, they wouldn't want to gain unnecessary attention from the government by raising prices too high. However, they see earnings growth mainly coming from volume growth and increased efficiency, by raising its utilization rate as opposed to continuous addition of new capacity.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员