机构:信达证券

评级:买入

To acquire Finnish Amer Sports at 39% premium

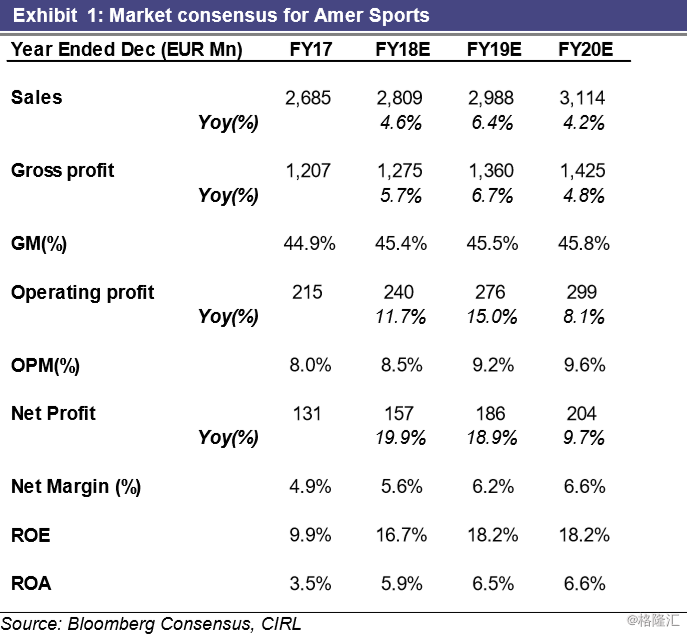

ANTA announced on Sept 12 before market opened that they and FountainVest (a PE firm) has submitted a non-binding preliminary indication of interest to acquire Finnish sports equipment maker, Amer Sports (AMEAS.HE), at EUR 40.00/ share (~39% preimum to Amers’ Sept 10 market close), and would be valued at EUR4.66bn (equivalent to RMB ~37.2bn). The bid translates into 25.1x/21.4x FY18E/19E PE, (vs. international peers average at 30.0x/23.0x) which we view it as fair.

The tender offer would subject to a number of conditions, including due diligence investigation, approval by shareholders holding at least 90% of shares of Amer Sports, approval by FountainVest’s investment committee and the receipt of all necessary regulatory approvals. Market rumours stating the deal would be finalized by the end of 2018.

To duplicate FILA story and further adopting multi-brand strategy Founded in Finland in 1950 and listed in Nasdaq Helsinki in March 1977, Amer Sports is a sporting goods company with internationally recognized brands including Wilson, Salomon, Arc’teryx, Atomic, Mavic, Suunto, Precor and recently acquired Peak Performance. Amer currently sells its products to trade customers (including sporting goods chains, specialty retailers, mass merchants, fitness clubs and distributors) and directly to consumers through brand stores, factory outlets, and e-commerce. Amer Sports own sales organization covered 34 countries (including China) in end 2017. Upon successful completion of the deal, Amer sports will further enrich ANTA’s current product and brand portfolio, which already consists of Descente, Kolon Sprandi and Kingkow (acquired in 3Q17).

Amer’s net sales and EBIT grew at 5.8%/2.0% CAGR in 2013-2017, which was slower than ANTA (23.0%/23.7% CAGR in FY13-FY17), while both GM and EBIT margin were also lower than ANTA’s. We noticed that Amer’s China revenue grew 15% to EUR120mn in 1H18 and accounted for 4.4% of Amer’s net sales/ 30% of Asia Pacific’s net sales (vs. ~4%/28% in 1H17), and Amer target a long term sales target at EUR 200mn. We believe ANTA targets to duplicate FILA’s successful story in China market, through enhancing Amer’s operation in China thanks to ANTA’s regional network, supply chain resources and logistics infrastructure, which would lift sales and bring cost-savings to Amer Sports in the long run.

Market woes on near term financing and lack of managing international brand experience weigh on share price

Since the deal was announced by ANTA, their share price has been down by ~10% on near term financing concerns. Assuming ANTA to acquire 51% stake in Amer Sports, which means ANTA would have to pay RMB18.9bn for the deal, with RMB9.0bn net cash on hand in 1H18, we believe part of the deal would make use of the net cash, while the remaining would make use of other funding sources. Management provided some colours on the deal that it would be financed through internal source and existing banking facilities, while capital market action would be at a lower pecking order. However, we believe the final stake in the acquisition and hence the amount of debt financing) would remain an overhang on share price. In addition, market also worries that ANTA is inexperienced in managing international brand would also weigh on share price.

FY19E 13.6x ex-cash PE, Maintain BUY on solid fundamentals

We maintained our FY18E/19E EPS forecast, which means ANTA is expected to deliver a 25.5% EPS CAGR in FY17-20E, therefore ANTA’s FY19E 13.6x ex-cash PE looks attractive to us (~53% discount to international peers at 29.2x). We slightly lower ANTA’s TP to HK$53.40 on lower RMB assumption, implying an unchanged 23.4x FY19E ex-cash PE (20% discount to international peers), plus FY18E net cash (RMB$4.27/share). We maintain ANTA’s rating at BUY.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员