机构:东方证券

评级:收集

目标价:0.75港元

1H18 topline growth in line. 1H18 revenue grew 6.9% YoY to HK$1,470mn, roughly in line with expectation, supported by stable growth of telecommunication segment (+3.8% YoY) and strong growth of industrial segment (+38.4% YoY). OPPO remains its largest client, contributing ~HK$340mn (23% of total revenue) in 1H18.

New clients added – Vivo and Amazon. Ten Pao will start shipment of smartphone chargers to Vivo at end-September, and is already manufacturing power supply for Amazon Echo. We estimate ~HK$60mn revenue contribution from these two new clients this year, and it represents a good start for building business relationship with renowned brands. Ten Pao is also considering whether or not to supply for Xiaomi given their low ASP and margin.

Strong growth of industrial sector, shares gain from Makita. Ten Pao secured an orders from Makita in 1H18 and it makes Makita Ten Pao’s fourth largest client in 1H18 (contributing HK$78mn). Bosch (contributing HK$250mn) and Black and Decker (contributing HK$91mn) remains Ten Pao’s second and third largest client in 1H18.

Price hike of its key raw material like MLCC. The recent price hike of key raw materials like passive components starting end-2017 is the most severe in decade, and Ten Pao’s margin is significantly dragged by the raw material price hike (MLCC, MOSFET) and its 1H18 GP margin dropped 8.8ppts to 10.7%. Ten Pao has added new suppliers to mitigate the impact and has seen effect, and the margin should improve HoH in 2H18.

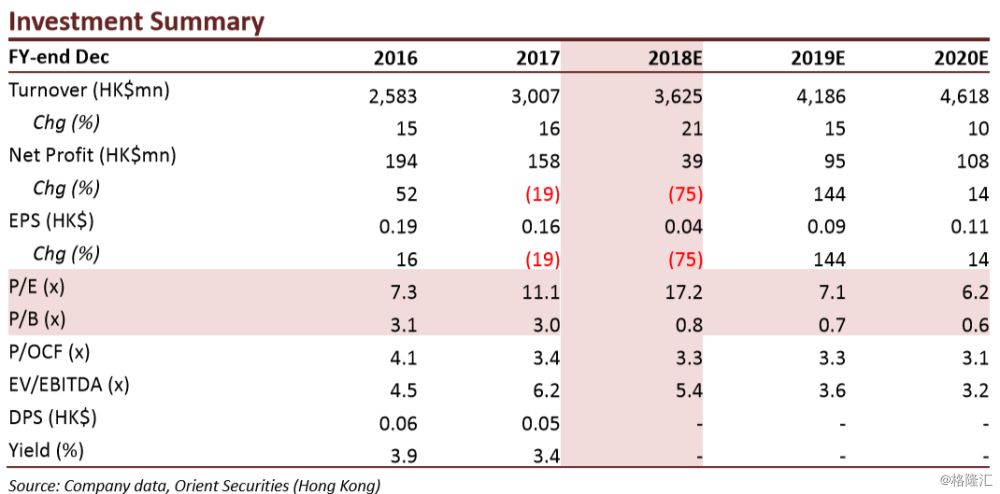

Downgrade to Accumulate. Due to the higher-than-expected raw material price this year, the share price has dropped 60% YTD. The shares are now trading at 17.2x/7.1x 2018E/2019E PER. We adjusted lower our earnings forecast at we lowers our 2018E/2019E GP margin forecast down by 5.0ppts/4.5ppts, and based on the revised earnings we lower our DCF-based target price to HK$0.75, by keeping WACC and terminal growth rate unchanged. Our new target implies 19.3x/7.9x 2018E/2019E PER,12% upside. Downgrade to Accumulate.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员