机构:德意志银行

评级:持有

Maintain Hold – current dividend yield should provide good near-term support

SHKP reported strong FY18 results (stronger-than-expected margins and rental growth momentum picking up), with dividend growth beating expectations, continuing to reflect a quality management team. Yet, we expect macro headwinds (an imminent rate hike and uncertainties in relation to the trade war) to override in the near term. Meanwhile, the primary sales market is increasingly competitive, as reflected in a 21% YoY increase in the vendor financing balance, although HK contracted sales actually declined 8% YoY. FY18 dividend yield surpassing 4% should provide medium-term support; Hold.

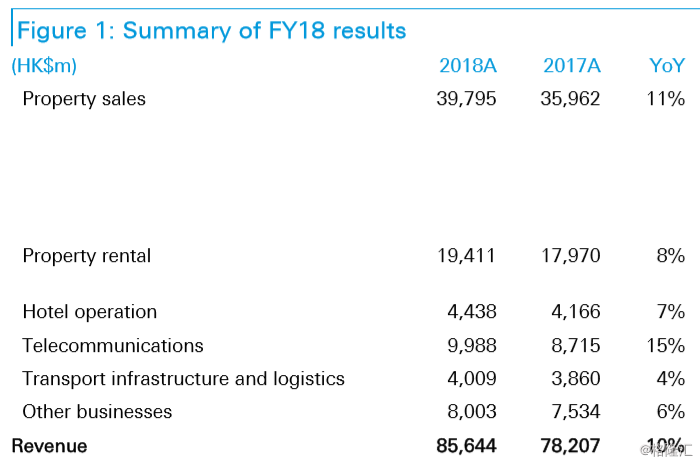

FY18 underlying earnings +17% YoY to HK$30,398m, beating our expectations

SHKP reported FY18 underlying profit of HK$30,398m, implying a 17% YoY surge from HK$25,965m in FY17 and beating our expectations. The beat was predominantly driven by higher-than-expected development margins in HK and higher sales bookings in China. Final dividend of HK$3.45/shr was declared (+15% YoY), bringing full-year dividend to HK$4.65/shr (+13% YoY), representing a marked accelerating pace compared to FY17 at 6.5%.

Rental revenue +8.2% YoY, driven by strong operations/AEI/new projects

In FY18, gross rental income (including associates/JVs) rose by 8.2% YoY to HK$23,682m, with HK$18,506m from HK (+6%), HK$4,457m from China (+18% in HK$, +11% in Rmb) and HK$719m from Singapore (+7%). Strong growth in the China portfolio was particularly driven by new project completion and positive rental reversion. Overall growth momentum accelerated (FY18: 8.2%; FY17: 4%; FY16: 7%), with HK registering acceleration to 7.9% in 2H18 vs. 4.3% in 1H18 (2H17 at 3.2%/1H17 at 4.4%).

Development margins markedly improve in HK and China in FY18

A key reason behind the earnings beat in FY18 was higher-than-expected sales development margins. In particular, operating profit margins for the HK portfolio saw a 6.2 percentage point expansion to 39%. Those for the China portfolio saw an even stronger expansion by 14 percentage points to 37%.

HK landbank +9% YoY to 56.5m sf/China landbank -3% YoY to 64.5m sf

As of mid-2018, SHKP had a total HK landbank of 56.5m sf (+9% YoY), of which 22.7m sf was under development, implying 16% growth YoY following five projects that total 6.76m sf being added. In particular, the Shap Sz Heung project (farm-land conversion) boosted 4.8m sf GFA, and the Kai Tak project has total GFA of 1.3m sf. In China, total landbank fell by 3% to 64.5m sf, of which 50.7m sf was under development (down from 52.6m sf one year ago).

New target price of HK$135.1 is based upon a sum-of-the-parts approach; risks

Our target price is based on a sum-of-the-parts approach, and implies a 2019E P/E of 14x. We believe that applying a 5-7x P/E to HK property development and a 34% target discount to our estimated value of the respective investment property portfolio is appropriate in an ex-growth market. Risks: fluctuation in HK/China economies, adverse or favorable changes to interest rate trends and government policies.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员