机构:德意志银行

评级:买入

目标价:HK$76.2

Robust growth outlook intact despite macro uncertainties

AIA shares have been affected by Asian currency weakness and concerns about the impact of the Common Reporting System (CRS) on its HK business. We see these as overdone and we recommend that investors buy on weakness. Although there are macro uncertainties, we believe AIA should remain relatively defensive given its strong balance sheet and robust growth outlook. We expect AIA's VNB momentum to improve to 25% yoy in 2H18E, vs. 22% (AER) in 1H18 (or 17% on CER), driven by a growth pick-up in HK (22%, vs. 10% in 1H18) and continuous strong momentum in China. AIA shares are trading at 1.6x 2019E P/EV (vs. a three-year avg of 1.6x), which we see as attractive. With its unique competitive position in HK/China and its strong brand equity across Asia, we see AIA as a long-term outperformer in Asia's life insurance markets. We reiterate Buy with a target price of HK$76.2/share (21% potential upside).

HK growth to pick up

We believe concerns about CRS, which requires HK insurers to report insurance account information to the tax authorities in China starting Sept-2018, are overdone. Our channel checks indicate continued strong sales in HK, driven by demand for protection and long-term savings policies, which should not be affected by CRS. We note that offshore ANP turned a corner in 2Q18 with growth of 4% yoy, after declining for three consecutive quarters since 3Q17 (down 25-56% yoy). We expect VNB momentum to pick up in 2H18E (+22% yoy, vs. +10% in 1H18), helped by (i) a relatively low base last year, (ii) continued strengthening of the USD, which should boost mainland Chinese visitors' (MCV) demand, and (iii) risk aversion amidst the current weak investment market sentiment, which should increase the appeal of insurance policies given their stable return and protection element. This, along with continued strong growth in China (DBe: +42% yoy), should support robust growth in 2H18E (DBe: +25% yoy).

Macro headwinds to weigh on shares but impact manageable

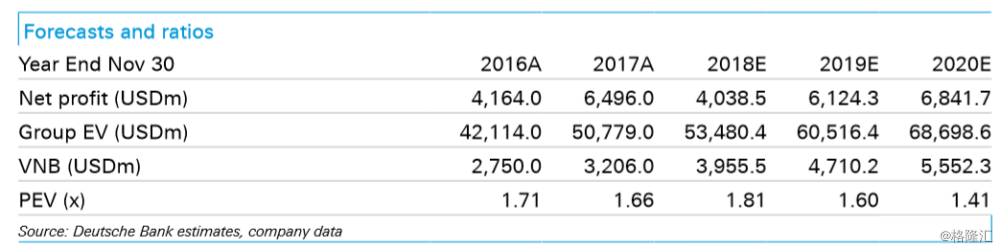

Currencies and equity markets in AIA's key markets have continued to weaken in 2H18, which will inevitably put pressure on AIA's EV and VNB. We have lowered our 2018E/2019E/2020E EV by 2.7%/2.6%/2.5% to factor in investment losses of ~US$1bn in 2H18E (vs. US$1.4bn in 1H18) and currency losses of US $746mn (US$754mn). We note that the impact on VNB (based on yoy changes in currencies) should be relatively muted in 2H18E (~1%), hence we have left our VNB forecasts unchanged. Based on company disclosure, for every 10% change in equity prices, AIA's EV would change by 1.5%. For every 10% change in local currencies (against USD), its EV would change by 6.4% and VNB by 6.2%.

Reiterating Buy; raising target price to HK$76.2/shr

Besides lowering our EV forecasts, we have also lowered our target NB multiple to 12.2x (from 15.1x previously) to account for macro uncertainties. However, we have raised our target price by 3% to HK$76.2/share, mainly driven by a roll forward to 2019E (+16%), which more than offsets the lower EV (-3%) and target NB multiple (-10%). We continue to see AIA as a long-term core holding given its strong brand equity in Asia and management track record. Investment risks include significant weakness in Asian investment markets, unfavorable regulatory developments, and weaker-than-expected growth.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员