机构:东方证券

评级:持有

目标价:5港币

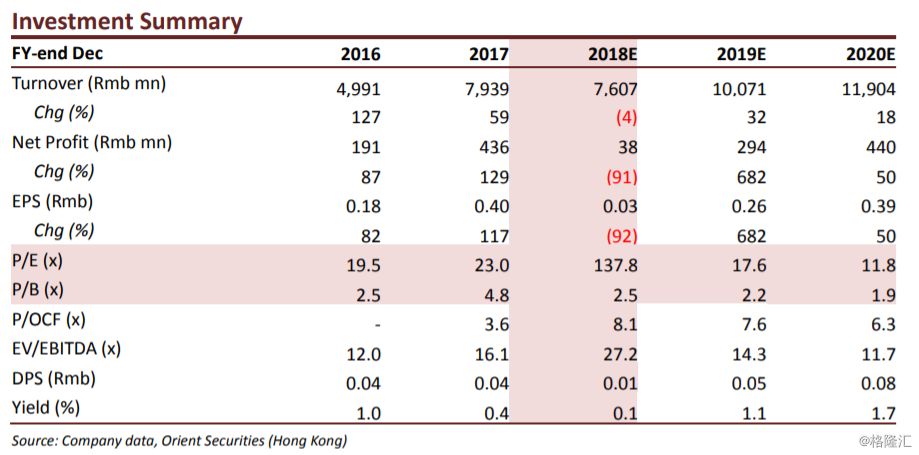

Q-tech’s 1H18 revenue of Rmb3,206.7mn (down 11% YoY) and net loss ofRmb51.3mn is roughly in line with market expectation given previous profitwarning, but the 1.2% GPM is the major disappointment. GPM was dragged byvarious factors including unfavourable product mix change, higher depreciationcost and one key project loss, etc., and will slightly recover in 2H18 as 3D sensingCCM and underglass FPM will contribute higher ASP and margin. 2019 growth willbe driven by increasing demand for 3D-sensing CCM and underglass FPM (for fullscreen). We revised down our 2018E/2019E net profit forecast to reflect lower ASPand worse-than-expected margin erosion. We revised down our DCF-based targetprice from HK$6.5 to HK$5.0, 16.4x 2019E PER. Maintain HOLD on 7% downside.

CCM & FPM ASP drop. Q-tech’s 1H18 CCM ASP dropped to Rmb25.1 (Rmb30.9 in 1H17and Rmb37.3 in 2H17), mainly due to 1) unfavorable change in product mix as thecompany accepted many low-end CCM projects (<5MP) for Huawei in 1H18, with theshipment volume percentage of <5MP CCM increased from 27.7% in 1H17 to 46.5% in1H18, 2) mid-to-low-end DCM are shipped as two single cameras and 3) fiercer industrycompetition in 1H18. On the other hand, ASP of FPM also dropped significantly by 54%YoY to Rmb17.1, mainly due to increasing competition.

Worse-than-expected GPM due to mainly internal factors. 1H18 CCM GP margindropped to only 3.3% from 13.3% in 1H17, while FPM GP margin dropped to -7.9% from8.8% in 1H17. Various factors affected the GP margin and ranked by their extent ofimpact are: 1) slower-than-expected product mix improvement, lower ASP withincreasing raw material price, 2) higher fixed asset and thus higher depreciation cost, 3)higher labor cost and 4) Rmb depreciation in May and June. Loss from one of the keyFPM project with Huawei also resulted in the negative GP margin of FPM business.

ASP and GPM to slightly recover in 2H18. The management believes that ASP andmargin will start to rebound in 2H18 as 1) the company already started to supplyhigh-end CCM for Huawei, 2) the industry competition and price war in 1H18 has easednow, and 3) high-end projects like 3D-sensing structure light camera modules (>1mnunits) and underglass FPM (>7mn units) will contribute higher ASP and margin in 2H18.Product mix will improve as Q-tech start to supply high-end CCM models for Huawei, 3Dsensing models for OPPO and underglass FPM for Vivo.

Maintain HOLD. We revised down our 2018E/2019E GPM forecast by 4.9ppts/6.4pptsand revised down 2018E/2019E net profit by 81.3%/64.8%. 2019E FPM revenue isrevised up by 9% to reflect the strong demand for underglass FPM expected next year.Growth driver for next year include strong demand to adopt underglass fingerprintrecognition and 3D sensing camera. We revised down our DCF-based target price fromHK$6.5 to HK$5.0, 16.4x 2019E PER. Maintain HOLD on 7% downside.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员