机构:银河证券

评级:买入

目标价:HK$3.15

Investment Highlights

Core Business Continues to Shine. Since COPL acquired CITIC Property Service in Dec 2017, the Company restated its financial statements. Reported 1H18 EPS was up 38.6% YoY to HK$0.672, which shows that COPL has been good at controlling costs. This can be seen in SG&A, as it grew by only 3.8% YoY to HK$240m. We believe this excellent cost control initiative comes from the China Overseas Group tradition. On the downside, value-added services remained lacklustre. Revenue grew by 34% YoY to HK$135m, but GP grew by only 9% YoY to HK$61m, as GPM deteriorated by >10 ppt to 45.3%. Like its major competitors, COPL launched many new services, but we don’t expect them to be a significant profit booster yet.

COLI Still Offers Opportunities for Future Growth. Hence, we expect its core business to remain the highlight for COPL, as it can differentiate itself with its strong cost control measures. We expect the acceleration of COLI’s construction to provide growth support to COPL in the medium term.

Exploring Other Options to Expand. The Company mentioned that it will continue to focus on scale. We expect COPL to ramp up its efforts to secure more third-party projects to be as competitive as its peers. It is considering entering Tier3/4 cities and even developed markets. We believe the Company has the capability to do this. It has a strong brand name in the Mainland, as well as a strong presence in Hong Kong and Macau. These two factors will allow the Company to enter other markets sooner than its peers, but it will be a long-term catalyst.

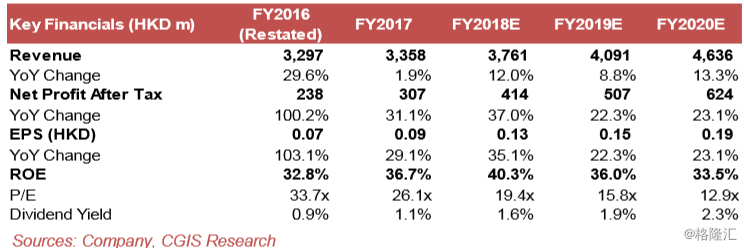

Time to Revisit. Upgrade to BUY. We have revised our model to assume stronger core business, but expect this to be offset by weaker value-added services. Therefore, our 2018E/19E EPS forecast of HK$0.13/0.15 remains unchanged, as does our TP of HK$3.15 (based on 25x 2018E PER). This may be a good time to revisit the stock after the market correction. We also believe the Company’s high earnings visibility will be favoured by the market.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员