机构:麦格理

评级:买入

目标价:16.60港元

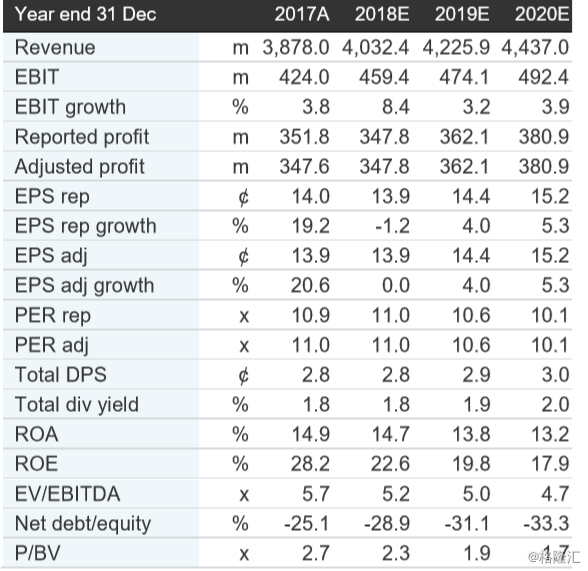

Wednesday morning at 6:30am HK time Nexteer announced its 1H2018 results. It will host a conference call for investors Wednesday morning at 8:00am HK time. Given the relative strength of 1H17, we view the 3.7% rise in revenues and flat operating profit as a slightly better-than-expected outcome. The new order backlog rose to $24.9bn from $23.9bn at the end of December 2017, which we view positively. We maintain our positive view on Nexteer, which we believe will continue to take share in the global steering industry as technical demands rise due to automated driving.

8 new programs underpin revenue growth: Revenues were underpinned by the launch of 8 new programs across multiple product lines, regions and customers. In North America the FCA RAM 1500 was one of 2 new programs. In Asia there were 6 new programs including the GM Excelle, SGMW Wuling Rongguang and 2 Changan models for CEPS, a column program for the FCA Grand Commander and driveline for Maruti-Suzuki’s Swift Dzire Tour. Balanced growth led by EPS: EPS (electric power steering) led revenue growth, rising 5.1% to US$1,321bn, as the US edged up 2.9%, while Europe rose 15% YoY. Driveline was up 5.0% to US$304m, doing better than we expected.

Better-than-expected margins: After the sharp HoH decline in the gross margin from 1H to 2H in 2017 (1H: 18.8%; 2H: 15.9%), the GPM recovered HoH to 18.1%. As a result, the operating margin recovered to 11.7% from 9.9% in 2H17, but below the record 12.2% level in 1H. This is ahead of our and market consensus 11.4% for the full year.

EBITDA up 1.3% YoY; strong cash flow: EBITDA rose 1.3% YoY to $441m as depreciation and amortisation fell HoH. The EBITDA margin was 16.1% vs 16.6% in 1H17 and 14.7% in 2H17. Free cash flow jumped 34.4% YoY to $183m from $136m in 1H17 and $131m in 2H. NPAT was up 11.1% as the effective tax rate dropped to 12.6%, lower than expected.

Leader in future technology: Nexteer notes that it has 12 programs in development for Levels 3 – 5 automated driving with key OEM partners. Of its backlog 10% relates to Levels 3 – 5 ADAS programs. It was a key contributor to GM’s first Level 5 ADAS vehicle. Overall we see market share concentrating further among leading companies like Nexteer as the technology becomes more complex.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员