机构:麦格理

评级:买入

目标价:9.50港元

Key points

LM’s recent px hikes more than offset increased costs from 25% OCC tariff

RPB a cheap alterative to US OCC. Coal-to-gas to push out small mills

Reiterate OP – more price hikes/shutdowns soon, cheap valuation

Price catalyst

12-month price target: HK$9.50 based on a Price to Book methodology.

Catalyst: 1) price hikes in late Aug; 2) environmental checks from Aug

Action and recommendation

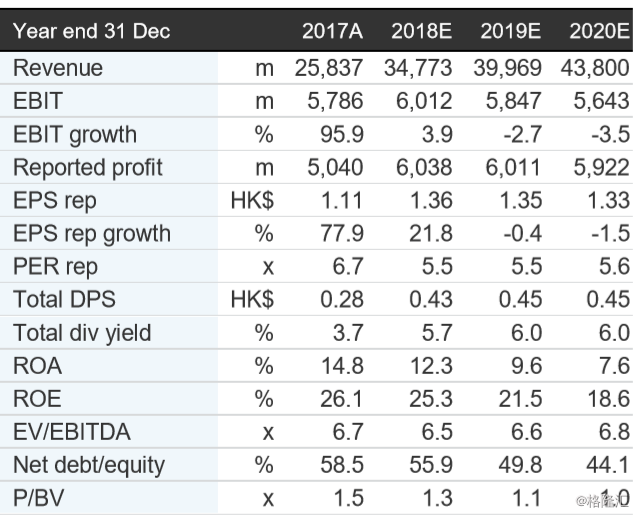

Reiterate OP – We believe LM has oversold (-15% in past week) on the 25% US OCC tariff news. LM trading at just 5.5x 19E PE (LT ave. 8x), 22% ROE, 6% div yield. Mgmt share buyback could provide downside support.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员