机构:招银国际

评级:买入

目标价:56.8港元

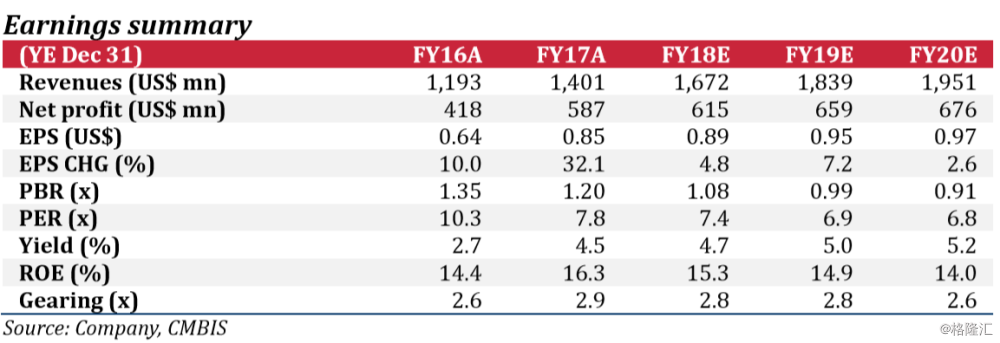

1H18 results inline. Lease rental income increased 24% yoy, reaching US$753mn, in line with our full-year forecast of 20%. Total revenues and net profit increased 23% and 24% respectively, to US$825mn and US$297mn, in line with our full-year net profit growth forecast of 22% (excluding one-off tax adjustment).

Net lease yield remained stable at 8.5%. In 1H18, average cost of debt increased 0.3ppt from YE17 to 3.1%, reflecting rising USD Libor. Lease rate factor responded to increasing cost of funds by also rising 0.3ppt from YE17 to 10.8%. As a result, net lease yield remained stable at 8.5%. The 3-month USD Libor has risen 0.62ppt YTD. Thus we revise FY18E average interest rate up 0.1ppt to 2.9%, lease rate factor up 0.2ppt to 10.8%, and net lease yield up 0.1ppt to 8.5%. As a result, we forecast FY18E net profit to increase 5% to US$615mn (24% excluding one-off tax adjustment), up 2% compared with our previous forecast.

Fleet owned and managed increased to 324. During 1H18, the Company took delivery of 27 aircraft, and sold 19, bringing total fleet owned and managed to 324 aircraft. Although 27 deliveries in 1H18 is in line with guidance on full-year delivery of 58, management expressed concerns over delayed delivery of Airbus due to engine shortage. Airbus CEO confirmed full-year outlook earlier in a statement, but deliveries in 2H18 may be concentrated in 4Q, putting pressure on the Company’s liquidity. The Company steps into 2H18 with cash and undrawn credit facilities totaling US$3.9bn, which may provide a cushion for the above situation.

Reaffirmed minimal impact from US-China trade war. Management reaffirmed little impact seen from US-China trade war, because 1) the Company does not have any Boeing aircraft scheduled for delivery to China (including private jets and Boeing 737-800NG that may be subject to tariffs); 2) compared with US public peers, the Company is incorporated and based in Singapore, giving it a neutral position.

Valuation. IATA reported 7% passenger traffic growth for 1H18, and projected 7% growth for the full year, above long-term trend of 5%. We remain positive on the Company’s future outlook. We value the Company at 1.2x P/B. It is currently trading at 1.1x 2018E P/B. Raise TP to HK$56.8, upside potential is 15.1%, maintain BUY.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员