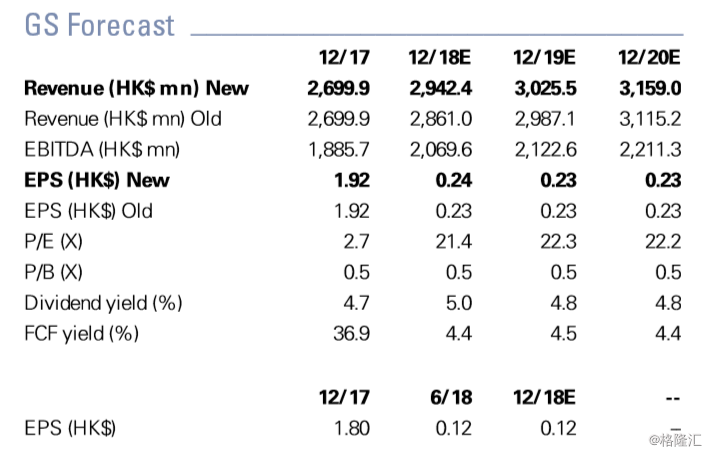

机构:高盛

目标价:6.39港元

DPU grew 7 .0% yoy to HK$ cents 12.53 (verus GS’s HK$ centsn 11 .71).

Revenue grew by 10.1% yoy to HK$1 .3bn, of which rentaln income from Three Garden Road and Langham Place Mall grew by 12%/ 11% respectively.

BVPS grew by 6.6% hoh to HK$11 .05/unit amid positive rentaln reversions while cap rates were unchanged (Three Garden Road/ Langham Place Mall/ Langham Place office at 3.60%/ 3.75%/ 4.00% respectively)

Three Garden Road:

Positive reversions (spot rentals reach HK$130s psf p.m.o LFA for small offerings, vs entire building’s passing at HK$96) plus higher occupancies into 2018 (up 4.6pp hoh to 98.8%).

New demand are mainly from Chinese financials ando flexible workspace operators (account for 5% of their space now).

Minimal expiry in 2H2018E, but with 42% space up foro re-pricing in 2019E (of which 20.2% is leases expiry and 22.4% is rent review), amid negative supply in Central (as Hutchison House will be redeveloped), which will give rise to more opportunity to potentially close their gap between passing rent and spot rent.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员