机构:银河证券

Better positioned to benefit from the rising intra-Asia logistics needs of Chinese companies: SITC focuses only on the intra-Asia trade market. It has a unique business model, offering integrated sea freight and land-based logistics services to its customers, which makes it more of a logistics company than a shipping company. It provides high-frequency container shipping services in its high-density intra-Asia route network (Fig 21), which gives it a competitive edge in building relationships with numerous Fortune 500 companies for their intra-Asia logistics needs. As at the end of 2017, SITC ran 77 vessels and operated 63 trade lanes. Its high-frequency seafreight logistics services make 388 port calls per week. With its highfrequency service network and long track record in the intra-Asia market, it should benefit the most from the growing intra-Asia logistics transportation market as more Chinese companies relocate to ASEAN countries.

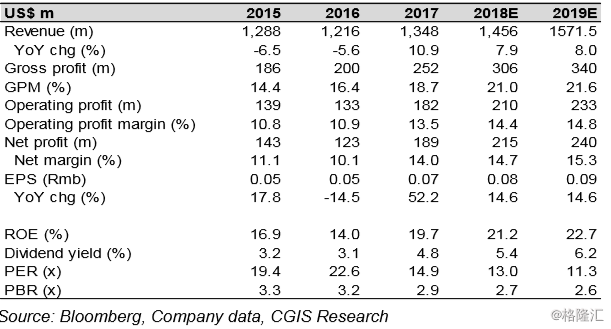

Valuation: SITC’s share price rose 63.6% in 2017, led by strong earnings growth recovery in 2017. The share price has risen 7.1% CYTD vs. a decline of 7.6% in the HSI Index during the same period. The share price didn’t fall along with the market, as the market appreciates the unique value of SITC’s business concentration in the intra-Asia market, which should be less affected by a potential US trade war. With or without a US trade war, Chinese companies have started to expand to ASEAN countries. Given a potential US trade war, their business relocation pace will become even faster. SITC should be a key beneficiary of the rising intra-Asia logistics transportation market. Based on consensus earnings estimates, the stock currently trades at 13.0x 2018E and 11.3x 2019E PER, about one standard deviation above its historical trading average PER. The share price is well supported by its high dividend yield of 5-6%. SITC will keep its dividend payout ratio at 60-70% in 2018-2019E.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员