机构:中信证券

评级:买入

目标价:58.93港元

Alfacalcidol, which just passed the conformity evaluation, boasts huge market capacity.

The Company’s product mix is expected to be remarkably optimized as c. 10 generic drugs are expected to pass the conformity evaluation in 2018.

Rituximab bio-similar, whose use is being expanded to cover rheumatoid arthritis, is expected to generate synergies with the Adalimumab in clinical extension.

MaAb R&D is to start paying off soon. The Company is expected to unveil blockbuster product with annual sales revenue at Rmb1bn every year during the upcoming 5 years.

The Company boasts products full in the pipeline as it was among the top two in the A share health care universe by R&D input in 7 years out of the past decade.

Risks: Failure of drug R&D; decline in drug tender price; disappointing implementation of the two-invoice system.

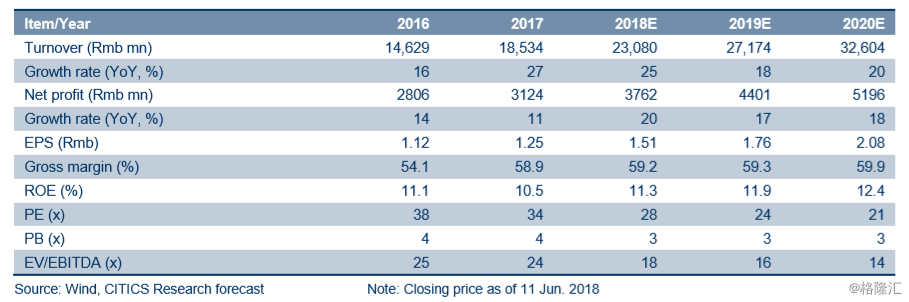

BUY retained. We expect its profit to expand quarter by quarter given the gradual launch of its products in the pipeline and recovery of Sinopharm Group (01099.HK)’s profit. We reiterate our 2018-2020E EPS estimates of Rmb1.51/1.76/2.08. After looking at comparables’ valuations and considering the valuation premium that the Company deserves as a leader in the pharmaceutical segment, we apply 35x 2018E PE to its A shares (or 32x PE to its H shares) and arrive at the TP of Rmb52.85 and HK$58.93 (based on the HKD exchange rate against RMB of 0.82) for its A and H shares respectively. We retain our BUY rating.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员