机构:麦格理

评级:中性

目标价:18.43港元

Event

We believe the acquisition of the new land king gives the company a good opportunity to ride on the strong retail growth and development of a quasi tier1 city. We believe the Hangzhou mall can charge the highest unit rental at Rmb700 psm/mth among Hang Lung’s mainland shopping malls except for Shanghai projects, which are charging more than Rmb1,500. However, as it will take six years to complete in 2024 and total investment cost could be as high as Rmb19bn with a 4-5% gross yield, the acquisition should negatively impact the earnings, cash flow and NAV in recent years. Some previous projects have had a long development cycle for five to nine years and experienced disappointing rentals. But the dividend should not be impacted as it is based on rental income of existing investment properties.

Impact

We estimate the unleveraged gross rental yield on cost at 3%, slightly lower than management’s forecast of 4-5%, which may be lower than other existing malls. In 2014, the yield on cost was 44% for Shanghai projects, 9% for Wuxi Center, 9-10% for Shenyang Forum, 7-8% for Jinan Parc and 5% for Shenyang Palace.

Hang Lung’s project will join the competition in Hangzhou, and it targets to compete with the mall with the highest sales in Hangzhou. The high-end malls in the Wulin district include Hangzhou Tower which opened in 1988, Wulin Intime and Kerry Centre. Hangzhou Tower’s retail sales achieved Rmb7.76bn in 2017, up 17.5% YoY, ranked in the top five in China. And total retail sales in Hangzhou amounted to Rmb571.7bn, up by 10.5%. We see the potential market of high-end malls, as Hangzhou’s GDP exceeded Nanjin in 2017 and it became one of the top 10 cities in China. However only one shopping mall from Hangzhou joined the top 20 malls in China, vs four malls from Nanjing.

Both Hong Kong and China have strong retail sales growth YTD 2018. China retail sales have increased ~10% and Hong Kong by 14% in 1Q18, led by the luxury segment. We believe Hang Lung can benefit from the strong retail market. However, the renovations in Peak Galleria in HK and Grand Gateway in Shanghai will impact the earnings temporally. Earnings and target price revision

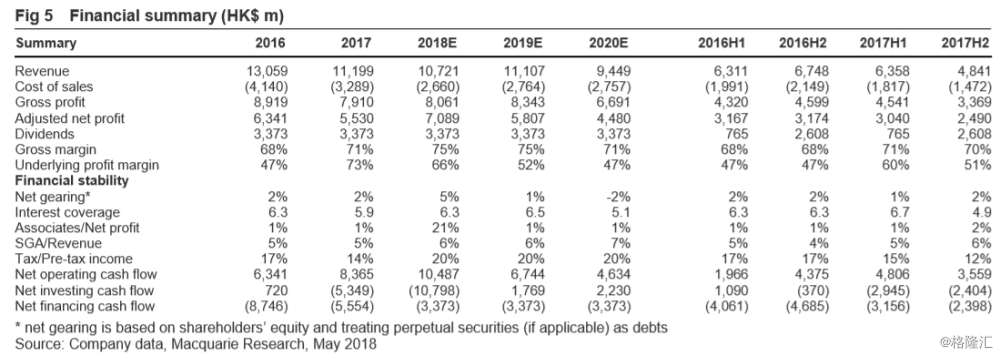

We lower our TP by 10% and earnings by 0.8-4.9% for 2018-20, as we add the new project in Hangzhou and increase Hong Kong rental assumptions.

Price catalyst

12-month price target: HK$18.43 based on a Sum of Parts methodology.

Catalyst: non-core HK IP disposal, performance improvement of China malls. Action and recommendation.

Maintain Neutral. Hang Lung Properties is trading at a 0.60x FY17 BV.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员