机构:交通银行

评级:买入

目标价:15.50港元

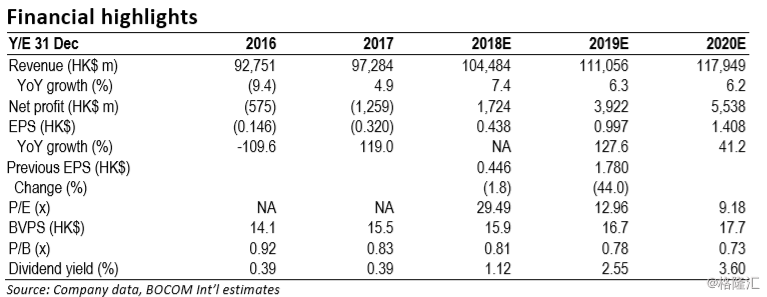

Cautious over capacity growth: Compared to PRC airlines that recorded double-digit RPK growth on their international routes, RPK growth of Cathay Pacific Airways (CPA) was moderate at only 2.7% YoY for 4M18. Meanwhile, ASK rose 3.1% YoY only during the same period, as CPA management pursues the policy of profitability improvement, rather than relentless market share expansion. 4M18 RPK growth of its European routes was, however, high, rising 7.1% YoY, as CPA stepped up to introduce more direct flights to new tourist destinations with lesser direct competition. Meanwhile, as a leading air freight operator, RFTK remained strong in 4M18, up 7.7% YoY. Last year, CPA’s cargo yield rose 11.3% YoY. Industry sources suggested that industry cargo yield surged further in 1Q18 on the back of robust demand.

Loss-making hedge book now becomes a blessing: CPA was on the wrong end of its hedging activities in the last two years with losses of HK$8.6bn/6.4bn in FY16/17, respectively. About 45% of this year’s estimated fuel consumption has been hedged at about US$80/bbl (Brent oil price) as mentioned by management in the last results announcement. While the strike price of these contracts is still hjgher than the prevailing Brent crude oil, we estimate the hedging loss this year will be substantially lower YoY. We raise our jet fuel price assumption of this year from US$69/bbl to US$84/bbl. Our earnings forecast for FY18E is revised marginally, largely due to the protection from its hedging books. Nevertheless, our earnings forecast for FY19 changes more significantly as the hedged volume for FY19 is much smaller under our current forecasts.

Maintain Buy: Compared to CPA, we believe the PRC airlines will be disadvantaged in 2Q18, and probably in the rest of the year if oil price stays persistently at the current level while no hedging measures are taken. We revise our FY18-19 earnings forecasts for CPA and introduce our FY20 forecast. We maintain our Buy call and target price of HK$15.50, which is equivalent to 1.0x FY18E P/B.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员