机构:交通银行

评级:中性

目标价:4.10港元

4QFY18 earnings slightly ahead of expectations: Solid PCSD (PC) margins and strong revenue growth for data center business (DCG) were the bright spots in 4QFY18, offsetting the continued weakness in its mobile segment. Quarterly revenue grew 11% YoY to US$10.6bn (vs. Street estimate of US$9.8bn). Pre-tax profit remained depressed at US$37m but continued to show YoY growth. While improving product mix and rising ASP were the main reasons for the strong PTI margin of PCSD, we believe USD weakness (especially against RMB in 1Q18, calendar year) also contributed to the margin strength.

Data center showing sustained growth; smartphone business still soft. 4QFY18 DCG revenue grew 44% YoY, helped by the strength from North American and EMEA, with hyper-scale, HPC and software showing solid growth. For mobile business, Lenovo intends to reduce the complexity of the business (e.g. by cutting models) and possibly exit some unprofitable emerging markets, in order to improve profitability. We continue to believe that scale is highly important to smartphone profitability, especially at the mid- to low end, and thus remain cautious on the outlook of Lenovo’s smartphone business.

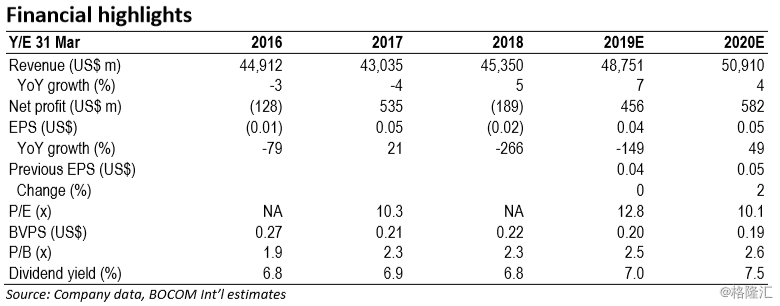

Earnings stabilizing; upgrade to Neutral on limited further downside: We believe Lenovo’s earnings outlook is stabilizing, helped by the improving prospect of DCG, but we expect smartphone business to remain a drag. Its shares have underperformed the market YTD (down 11% vs. HSI up 3%), and now trade at 12.8x FY19E P/E, largely in line with its closest peers HPQ/Asus of 11x/13x forward P/E. We fine-tune our FY19/20E net profit estimates by 2%/4%. Our new TP of HK$4.10 is based on 13x FY19E P/E (previously HK$3.70 on 12x FY19E P/E). Upgrade from Sell to Neutral.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员