机构:银河证券

Summary. The share price of Beijing Enterprises rebounded in the past few days, and we believe the rebound will continue, as the latest stub value of the Company implies its non-listed gas business is trading at a unrealistically low level of 0.95x PER. In particular, we believe some investors still treat the stock as a proxy of BE Water (0371.HK) and miss the fact that China Gas (0384.HK) accounted for more than half of the value of Beijing.

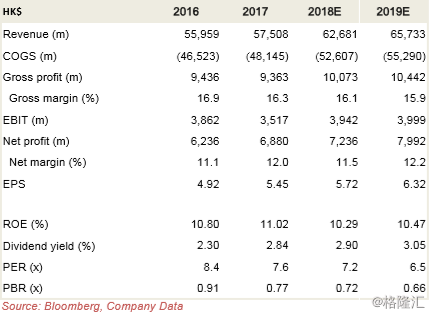

Enterprises’ listed assets. If we conservatively assume the stub value can trade at 5x PER, we see potential share price upside of 25%. Value of the listed assets. Currently the major listed assets of Beijing Enterprises include China Gas (384.HK; 24.91% stake), BE Water (0371.HK; 42.42%), Yanjing Brewery (000729.CH; 45.79%), BE Environment (0154.HK; 50.4%) and Biosino (8247.HK; 18.84%). Based on the closing price yesterday (May 17), the total value of the listed assets is about HK$69.7bn (Figure 1). The latest market cap of Beijing Enterprises, however, is only HK$52bn. Wrongly treated as a proxy of BE Water. Figure 2 shows the share price movement of Beijing Enterprises and BE Water in the past two years. It’s not difficult to see they move in the same direction in general. BE Water’s share placement early this year and its weaker-than-expected 2017 results led to a de-rating of the Company, which also affected the share price performance of Beijing Enterprises.

BE Water: Near the end of the de-rating. BE Water is currently trading at 9.3x 2018E PER, based on consensus. We believe this largely reflects the disappointing 2017 results. In addition, as we discussed in a research note dated May 14, the results of the PPP project review conducted by the authorities were better than expected, which should gradually remove concerns about the Company.

Further room for a rebound. The share price of Beijing Enterprises clearly outperformed BE Water in the past few days (Figure 2). We believe more and more investors found that the Company’s stub value is trading at an extremely low valuation. If the stub value can trade at 5x PER, there is a potential share price upside of about 25%. This is not a demanding level, as it implies only 9x 2018E PER. This is still far below China Gas’s 19.9x FY19E (March year-end) PER.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员