机构:招商证券

评级:买入

目标价:88港元

■ City gas sales vol. was up >20% YoY and gas dollar margin rebounded to RMB0.62/cu m in 1Q18

■ Targets to add 60 integrated energy projects and generate a revenue of RMB2bn in 2018

■ Maintain BUY and raise DCF-based TP to HK$88.0

Solid operational performance in 1Q18

ENN Energy’s city gas sales vol. was up >20% YoY in 1Q18, in line with mgmt.’s full year sales vol. guidance. Gas dollar margin rebounded from RMB0.6/cu m in 2H17 to RMB0.62/cu m as the pass-through rate of winter gas cost hike raised from 50% at the end of 2017 to 70-80% in 1Q18. Mgmt. reiterates a stable dollar margin of RMB0.63/cu m in 2018 thanks to 1) the cost saving of RMB0.1-0.29/cu m based on oil price of US$65-70/barrel (vs Zhejiang city-gate gas price of RMB2.19/cu m) from its LNG import, with import vol. target of 700mn cu m and 1.5bn cu m in 2018 and 2019, respectively; and 2) relieving gas supply shortage problem in winter season due to ramping up capacities of 5 new LNG terminals in 2017-18, resumption of gas supply from Middle Asia and accelerating construction of storage facilities.

Integrated energy business expansion on track

Mgmt. targets to add 60 integrated energy projects with a capex of RMB1.2bn in 2018. Together with its existing 31 projects, mgmt. guides the energy sales (incl. electricity, steam and hot water) will reach 6bnkwh and generate a revenue of RMB2bn in 2018 (vs RMB294mn in 2017) assuming an ASP of RMB0.4/kwh. Leveraging on its >90k C&I customers base, mgmt. projects the energy sales vol. and revenue will quintuple to 30bnkwh and RMB10bn, respectively, by 2020E. The gross margin is expected to improve to 10-15% once projects mature in 2-3 years.

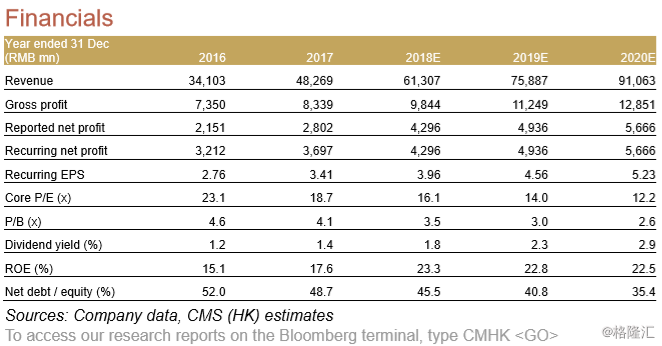

Maintain BUY and lift DCF-based TP to HK$88.0

Although we have factored in higher revenue assumption of integrated energy business, given its low margin during the early development stage, we only revised up our 2018-20E earnings by 0.7-2.1%. In addition, with more positive assumptions on the integrated energy business in the mid-long term and terminal growth rate, we raised our DCF-based TP to HK$88.0. The shares are trading at 2019E P/E of 14.0x, close to its 5-year historical P/E average of 13.9x. Valuation looks justified supported by the positive outlook. We reiterate our BUY rating.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员