机构:招商银行

评级:买入

目标价:15.74港元

Investment opportunity in a sunrise industry. In recent years, following the rapid urbanization and continuous growth in per capita disposable income, property management market starts revealing its economic value. We expect property management industry continues to grow in tandem with rising level of urbanization and demanding quality of uptown living. We are positive on the outlook of property management industry.

A promising new player in the market. A-Living is a reputable property management service provider in China focusing on mid- to high-end properties. After a series of reorganization and corporate restructuring in 2017, the Company’s H-shares were successfully listed on HKEX on 9 Feb 2018, with IPO price of HK$12.30. As at 31 Dec 2017, A-Living provided property management services in 69 cities in China with managed GFA of 78.3mn sq.m. Supported by Agile and Greenland. In Jun 2017, A-Living acquired Greenland Property Services from Greenland Holdings (600606 CH). In Aug 2017, Greenland Holdings was introduced as a strategic shareholder. Greenland currently holds 15% interest of A-Living, and A-Living now operates under the two renowned brands, “Agile Property Management” and “Greenland Property Services.” Continuous support from Agile and Greenland is the core investment theory of A-Living. Both Agile and Greenland have agreed to deliver substantial GFA amount to A-Living each year. Furthermore, Agile and Greenland are also tied with A-Living in its value-added services to non-property owner, property agency business in particular. We think property management companies whose shareholders are large developers will have the upper hand in the competition of scale.

Rapid expansion. According to the management, first task after IPO is to expand the scale through (1) organic growth and (2) M&A. Other than support from shareholders, A-Living also targets on 3rd parties projects. In 2017, ALiving founded a market development team with 200 elites focusing on obtaining 3rd parties projects. Net proceeds from IPO amounted to approximately HK$3,944.6mn, of which 65% will be spent in M&A and strategic investment. On 9 Apr 2018, A-Living announced to acquire 51% equity interest of Nanjing Zizhu Property Management at a total consideration of Rmb205mn.

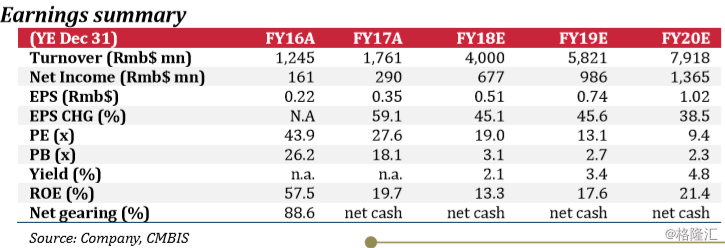

Initiate with BUY. We estimate EPS of A-Living to be Rmb0.51, Rmb0.74 and Rmb1.02 in FY2018-2020. Current share price is trading at 19.3x 18E PER and 12.3x 19E PER. With 25.0x 18E PER, our Target Price is HK$15.74. Upside potential is 32.0%. Initiate with BUY.

Investment risks: (1) Uncertainties in M&A (2) weaker than expected support from shareholders (3) weaker than expected growth of value-added services.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员