机构:银河证券

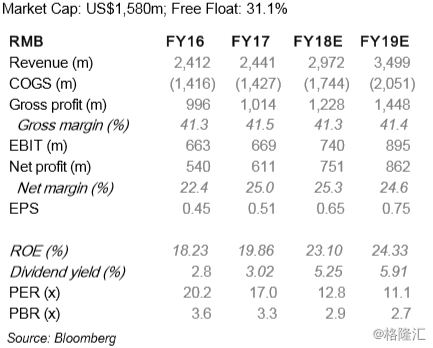

Summary. We attended the 2018 Winter Trade Fair organized by China Lilang and were impressed by its new products. The LILANZ brand is now shifting its focus to younger customers. Therefore, it will adapt its promotional campaign and distribution channels. It will open more stores in shopping malls and strengthen its e-commerce program in 2H 2018. We believe the Company is on track for its 200 POS net addition target, as well as sustaining growth momentum. Based on Bloomberg consensus, China Lilang is trading at 12.8x 2018E PER, with a 5.25% dividend yield. Given the recent rally in other mainland China-based apparel names, we believe the stock is worth a revisit.

The Company. Established in 1987, China Lilang is one of the leading menswear brands in mainland China. Lilang designs, manufactures and sells business and casual men’s apparel under the “LILANZ” brand, which targets mainly men in Tier 3 and 4 cities. As at 31 Dec 2017, the Company had 2,410 stores in China, which were operated by 72 distributors and 898 sub-distributors.

We Were Impressed with the 2018 Winter Trade Fair. We attended Lilang’s 2018 Winter trade fair in May. The new product series launched by the LILANZ core brand continues to be the brainchild of its design team, which consists of foreign designers with experience in major global male apparel brands. However, local designers are more capable of localizing and executing the design ideas generated by the foreign designers, resulting in products that match the needs of local consumers, especially in Tier 3 and 4 cities (Figure 1).

In the meantime, the Company’s new products continue to maintain the Company’s core strategy of “improving product quality without raising the price”. Specifically, we note that some of the key new products use imported fabrics, but the prices are similar to or even lower than those of its major competitors. Management believes young consumers now emphasize valuefor-money more rather than solely brand recognition and brand loyalty.

Transformation to a Younger Brand; Less Reliance on Celebrities. From our observation and discussion with distributors, Lilang’s major product series have incorporated more fashionable elements, and they target mainly young adults from 25 to 35. The Company believes the majority of consumption power rests in the “post-80s” and “post-90s” groups, i.e., those aged between 20 and 40. The smart casual collection, launched in 2016, is also an attempt to target younger customers. For advertising and promotion, instead of relying on celebrity endorsements, Lilang is now using more channels, such as promotions on railways and Weixin.

Adaptive Channel Management; Net Addition of 200 POS Unchanged. As a result of targeting younger customers, the focus of Lilang’s channel expansion has also shifted to shopping malls. The Company reiterated its 2018 target of a net addition of 200 POS (including both the core brand and smart casual series) . At the same time, to adapt to the new dynamic retail environment in China, Lilang will soon launch a “new retail” business model. That means e-commerce will be the focus of the Company, and it aims to sell more smart casual products, which requires less fitting in general.

Distributors Are Satisfied with The Company’s New Strategy. We also held discussions with Lilang distributors. Lilang underwent channel reforms few years ago, in which primary distributors were encouraged to set up more self-operated stores. The feedback from several leading distributors so far is positive, and self-operated stores set up by these distributors turned more profitable under the reforms introduced by the Company. The distributors also commented that Lilang’s strategy of ”improving product quality without raising the price” has worked, allowing it to outperform similar brands in terms of number of POS and store efficiency.

Valuation. Based on Bloomberg consensus. Lilang is trading at <13x 2018E PER, while the EPS CAGR between 2017 to 2019E is expected to be 21%. The Company also has net cash of RMB2bn. It has a long history of paying generous special dividends and is likely to offer a dividend yield of >5.3% for 2018E.

We believe there are two factors worth monitoring: (1) there may be further upside if the trade fair orders for Winter 2018 continue to record strong growth; and (2) the valuation of Lilang is still behind that of its peers. Given the recent rally in other mainland China-based apparel names, we believe the stock is worth a revisit.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员