机构:中信建投

评级:买入

目标价:30港元

Geely facelift model will continue to strengthen product cycle in 2H18, which makes the company’s 1.58mn shipment target look conservative, in our view.

We anticipate Lynk 01 sales ramp-up to begin to slow down after monthly shipments hit 10k units, due to limited room to increase production capacity albeit extending work shifts.

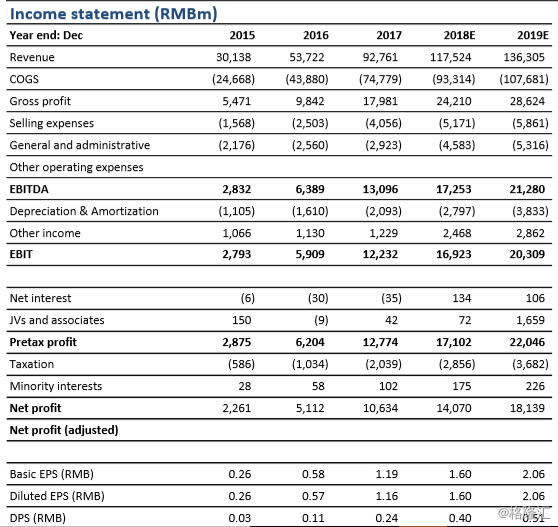

We reiterate our PT of HKD30.0, pegging on FY18E 13.0x PER of Geely and FY18E 1.8x P/S of JV Lynk based on its profitable outlook in FY19E. Given 30% upside potential, maintain Buy rating. Competitive facelift model launch to strengthen product cycle. Geely has accepted more than 2,000 units pre-orders of the newly launched Borui ( 博瑞 ) GE models with a starting price of RMB159.8k for the MHEVs and RMB198.8k for the PHEVs within one hour on 15-May. In our view, this is an outright demonstration of the competitiveness of its facelift models. Since the Borui GE models basically share the same production platform with the current ICE models which incur limited additional costs, we anticipate the margins of Borui’s models will thus be lifted continuously, in particularly once sales of the high-margin models ramp up in FY19E. Furthermore, Geely has sold c.128k units in Apr-18, up 49% YoY, amid the usual off-season and thus having attained 32% of the sales target for FY18E (1.58mn units in FY18E including Lynk) in the first 4 months. Meanwhile, given the low base during Jan-Aug in FY17, we anticipate Geely to post a more than 50% YoY shipment growth in May-18 that may drive the total shipments to ultimately largely outpace its year-end target.

Supply of Lynk 2.0T engines may begin to slow down after shipments hit 10k units. With the supply of the engines for the Lynk 01 models having increased significantly to 9k units in Apr-18 from 6k units in Jan-18, we foresee production supply to begin to slow down in the near term, in particularly once monthly sales volume exceeds 10k units, given the limited room to raise production capacity at the Zhangjiakou powertrain plant albeit extending the work shifts. On such basis, we estimate monthly Lynk 01 shipments to hover at around 10k units prior to 2H18 when the models equipped with the 1.5T engines are scheduled to be launched. Furthermore, we expect monthly production capacity will be increased substantially to more than 20k units in FY19E when the third CMA plant in Zhejiang (浙江) with a 300k unit production capacity, which will be exclusively used to produce the Lynk 01 models, commences commercial operation.

Attractive valuation: We reiterate our PT of HKD30.0, pegging on FY18E 13.0x PER of Geely and FY18E 1.8x P/S of JV Lynk based on its profitable outlook in FY19E. Given the 30% upside potential, we will maintain our Buy rating.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员