机构:中信建投

评级:买入

目标价:150港元

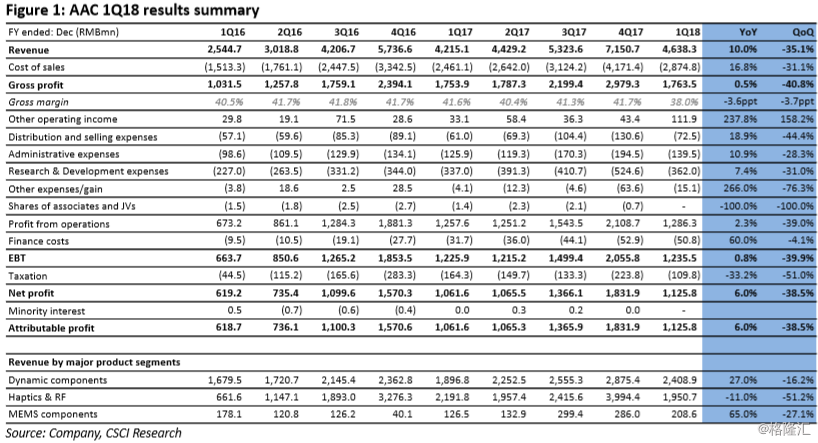

A stable set of 1Q18 headlines. As well expected, AAC’s 1Q18 headlines saw headwinds in the face of a stagnant smartphone industry and RMB appreciation. Revenue rose 10.0% YoY, driven by sturdy growth momentum of speaker modules (revenue +48.2% YoY) business but was dragged by weak haptics (haptics/RF revenue dropped 11.0% YoY). Gross margin contracted to 38.0%, down by 3.6ppt YoY, mainly due to RMB appreciation (3.2ppt erosion attributable to RMB appreciation).

Concrete progress of core businesses. Acoustic segment revenue saw a solid 27% YoY growth in 1Q18, driven by robust shipments and ASP of SLS speaker module for Android flagships (adopted on a flagship launched in 1Q18). Riding on an increasing proportion of proprietary MEMS dies and ASIC chips, the MEMS microphone business saw an upsurge in revenue (+65% YoY in 1Q18) coupled with a boost in gross margins per our estimates. Despite haptics/RF saw an 11.0% YoY decline in revenue, it is notable that AAC has achieved deepened penetration into top-tier Android customers with its X-Axis haptic motors and 3D cover glass, which have already started mass shipments in 1Q18.

Emerging businesses to bear fruit. AAC’s emerging optic business has expanded rapidly, with plastic lens shipments reaching 15-17mn sets in May-18 and are expected to expand to 25-30mn sets by 3Q18. Meanwhile, the interim target of WLG capacity to expand to 5mn/month (10mn by 4Q18) is well on-track. AAC is poised to begin mass shipments of hybrid lens for both the 3D sensing and imaging end-markets during 3Q-4Q18. We see promising outlook for hybrid lens using the WLG techniques given their superior optical performance and cost advantage.

Solid long-term growth outlook intact. We still see a promising FY18 underpinned by both wider and deeper penetration into the Android camp’s procurement as well as its sturdy position in the Apple supply chain. In view of the weaker-than-expected haptics business, we have trimmed our FY18E/FY19E revenue and profit estimates by 8.2%/12.4% and 12.4%/20.4% respectively, and lowered our DCF-based price target to HKD150. Maintain Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员