机构:银河证券

评级:买入

目标价:330.2港元

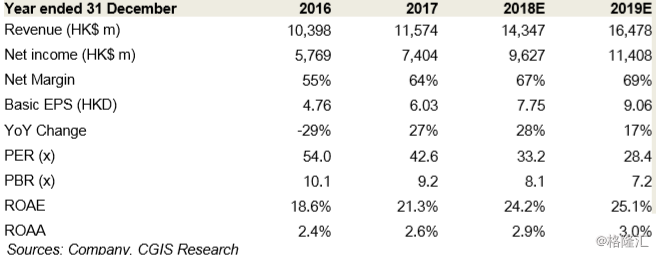

Net profit rose 49% YoY driven by 36% revenue growth. HKEx’s Q1 2018 net profit jumped 49% YoY to HK$2.56bn. Revenue and other income grew 36% YoY to HK$4.15bn. In particular, average daily turnover (ADT) in Q1 2018 rose 97% YoY, which led to a 58% increase in trading fees and clearing and settlement fees to HK$2.7bn. The EBITDA margin rose 4ppt to 77%, thanks to operating leverage, as its operating expenses increased by only 12%. Excluding one-off items in Q1 2017, the increase was even lower at just 9%.

Strong growth in Stock Connect trading. ADT of southbound trading was HK$19.7bn in Q1 2018, a sharp increase of 156% YoY. ADT of northbound trading also jumped 228% YoY to RMB19bn. Revenue and other income generated from the Stock Connect was HK$172m in Q1 2018, up 129% YoY.

LME the only weakness in Q1. Revenue from the commodities segment dropped 6.7% YoY to HK$344m. Excluding non-fee generating administrative trades, the average daily volume (ADV) of metals contracts traded on the LME grew 3% YoY. The moderate revenue decline was due to the impact of fee reductions for short- and medium-dated carry trades introduced as a result of the Strategic Pathway to enhance market activity. EBITDA from the commodities segment fell 32% YoY to HK$174m.

Decline in ADT in April; potential for a rebound. ADT YTD is HK$132bn, still in line with our full-year forecast of HK$135bn. ADT in April dropped to about HK$110bn, but we believe the mega IPOs, such as Xiaomi, to be launched later this year thanks to listing reforms should help drive a rebound in ADT.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员