机构:招商银行

评级:买入

目标价:28.98港元

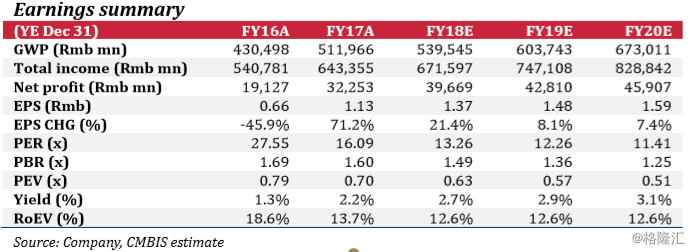

FYRP up 1.5% in 1Q18 thanks to bancassurance channel transition.

For the whole life insurance industry in China, 2018 kicked off to a very difficult start with lackluster growth in new business. China Life reported 1.5% yoy growth in first-year regular premiums to Rmb61.2bn in 1Q18. Such growth was mostly driven by the bancassurance channel. According to our estimate, individual agent channel is likely to have witnessed FYRP decline of ~5% in 1Q18, which is relatively modest compared to peers (Ping An FYP -16.6%, CPIC FYRP from agent -30.4%, NCI FYRP from agent -49.5%).

Turnaround in Mar due to the introduction of new product.

GWP decreased by ~20% in Jan-Feb but the decline narrowed quickly to 1.1% in 1Q18. In Mar 2018, the Company achieved GWP of Rmb88.8bn, representing yoy growth of 57.7%, boost mainly by “Sheng Shi Zhen Pin” (盛世臻品) annuity product. NBV margin of this product is likely to be below average, but the dragging impact will be limited since the product is sold only on a temporary basis.

We forecast nearly flat NBV trend in 2018.

On the positive side, NBV will be strengthened by (1) the transition of bancassurance channel towards regular premium business (single premiums were cut by Rmb51.3bn from a year earlier to Rmb9.4bn in 1Q18); and (2) the Company has linked agent compensation with value creation this year to encourage the sales of high margin products. On the negative side, however, worse-than-expected FYRP growth in 1Q18 has eclipsed the prospect of NBV for the whole year. We adjust our forecast for FY18E NBV forecast from Rmb67.4bn to Rmb61.2bn, representing yoy growth of 1.8%.

Profit surged due to RDR assumption changes.

Changes in assumptions, in particular risk discount rate assumption, led to an increase in pre-tax profit by Rmb2.7bn in 1Q18 whereas last year assumption changes reduced pre-tax profit by Rmb13.3bn. Since the 750d m.a. bond yield curve has bottomed out, we believe assumption changes will contribute positively to profit in 2018.

Less aggressive alternative asset allocation.

The Company will increase allocation in government bonds with long maturities in 2018. Investment in alternative assets will be much less aggressive as a result of asset management regulations. In 1Q18, ~Rmb20bn new money was invested in alternative assets, compared to ~Rmb200bn last year.

Remain one of our insurance top picks.

In spite of industry headwinds in 1Q, fundamentals remain intact for China Life and the overall life insurance industry. The Company’s agent team management and technology initiatives bode well for future development. We adjust TP to HK$28.98 to reflect weaker NBV forecast. TP corresponds to 0.81x/0.73x FY18/19E P/EV. Maintain BUY.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员