机构:招商证券

评级:BUY

目标价:21.80 港元

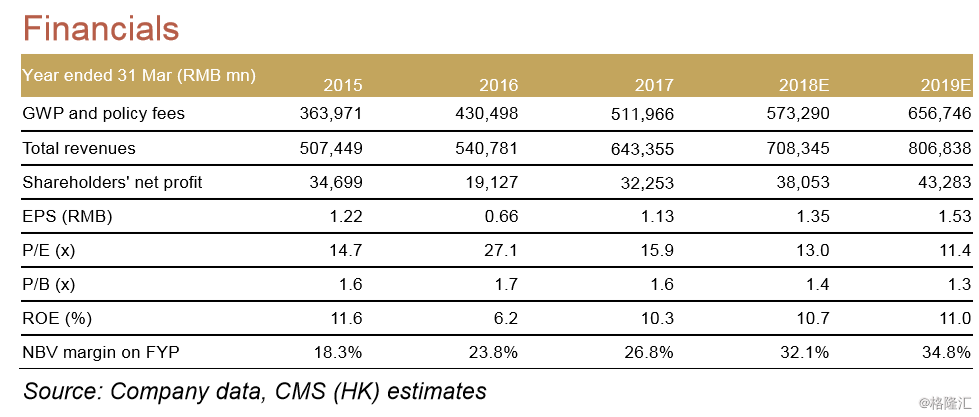

Regular FYP up 1.5% YoY in 1Q18 1) 1Q18 shareholders’ net profit totalled RMB13.6bn, up 120.7% YoY, inline with the profit alert earlier. Comprehensive income was RMB14.4bn. ROE (not annualized) came in at 4.2%. The significant increase in net profit was partly attributable to the changes in the discount rate assumption of reserves of the traditional insurance contracts, in-line with our view on the sector; 2) regular FYP grew by 1.5% YoY, while single premium sharply dropped 84.6% YoY, meaning improved premium structure and improved NBM. We like China Life’s improved premium structure in 1Q18. We also think the company’s NBV performance in 1Q18 should be acceptable as there is positive growth in regular FYP. Furthermore, the company may continue to benefit from the turnaround of 750D-MA for the 10Y government bond as the line is still rising. Management guidance 1) The company earlier indicated that the key strategy for 2018 will be to continue strengthening the sales of protection products; and 2) the company owns the largest exclusive agent force in the industry (as of 2017-end), hence having competitive advantage in selling long-term protection products. Valuation and risk The stock is trading at ~0.6x 18E P/EV. Our TP (currently HK$36.4) and 2018 financial forecasts are under review. We maintain “Buy” for China Life, given that: 1) the company is trading at only ~0.6x 18E P/EV, a large discount to its average P/EV over the past five years of ~1.05x; 2) we like the company’s enhanced product mix (higher NBM on FYP) and positive growth in regular FYP in 1Q18; and 3) as a pure life company, it may benefit from the rising 750D-MA for the 10Y government bond (the 750DMA generally went down in 2017 and negatively impacted its 2017 operating profit by ~21%). Key catalyst: better-than-expected NBV growth in 1H18. Key downside risks: adverse capital market, lower-thanexpected NBV growth.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员