机构:国信证券

评级:BUY

目标价:7.00 港元

Argon’s acquisition completed, turning to net profit in 2020.

On 24 Jan 2018, Weigao announced it had completed the acquisition of Argon Medical Devices Holdings (US’ high-end specialty device maker). The cash consideration was USD844m (RMB5,307m). As in our 27 Sept 2017 report, its balance sheet has to be geared up and we now factor in RMB3.4bn of long-term borrowings and RMB889m of short-term debt. This makes up a gearing of 9.0% at end-2018, vs a net cash of RMB3.0bn at end-2017. We expect Argon to stay at net loss in FY18F-19F of -RMB172m and -RMB73m, turning to a net profit in 2020.

Argon’s revenue to grow 10% y-o-y in 2018 post consolidation. We forecast Argon’s biopsy and drainage catheters sales taking up 45% of Argon’s FY18F revenue, the rest being from vascular clot management and guidewires. This is based on our assumption of biopsy and catheters at USD102m in 2012 vs Argon’s total revenue at USD225m in 2016. We project each of these area sales to grow at 10% y-o-y for this and next year (FY17:5%). Post conference call on 27 Mar, 22 of existing Argon products had obtained CFDA approval, ready for China sales soon

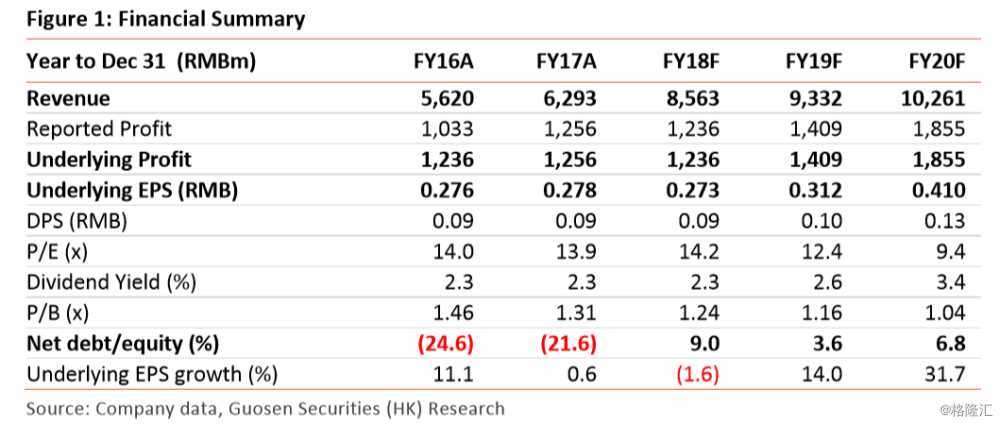

2018: Consumables/ orthopaedic/ total sales at 11%/13%/36% y-o-y. On the same day, Weigao reported its 2017 net profit at RMB1,256m, the same number as the core profit which was up 2% y-o-y. This was 13% below our and Bloomberg consensus estimate, on (1) smaller Weigo blood purification profit as an associate; and (2) higher operating cost (opex) to sales. Post analyst call, we expect Weigao’s consumables and orthopaedic products sales to rise at 11%/13% y-o-y in 2018. Consolidating with Argon’s revenue and removing blood purification sales as discontinued operation, our total revenue growth y-o-y will be 36%/9%/10% in this and next two years, with our revenue up 3% each year.

TP rises to HKD7.00 (from HKD6.35). Upgrade to BUY. On higher opex to sales (1) in 2017 at 41.6% vs our expected 38.7% and (2) post Argon’s consolidation in 2018, we cut our earnings to RMB1,236m (from RMB1,624m) in 2018 and to RMB1,409m (from RMB1,771m) in 2019. Our earnings now accelerates from 2% y-o-y decline in 2018 to 32% y-o-y growth in 2020. Adding Argon’s valuation, our SOTP-derived TP lifts to HKD7.00 (from HKD6.35). This reflects 21.2x FY18F P/E (from 15.1x), (1) below sector target median at 24.0x; and (2) at par to past 5-year forward P/E mean at 21.0x. We deem the stock to be undervalued at 14.2x FY18 P/E vs sector’s 21.0x on being China leading medical consumables suppliers, integrating US high-end specialty device post M&A.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员