机构:德意志银行

评级:Hold

目标价:76港币

Cost jaws reiterated at 1-2%

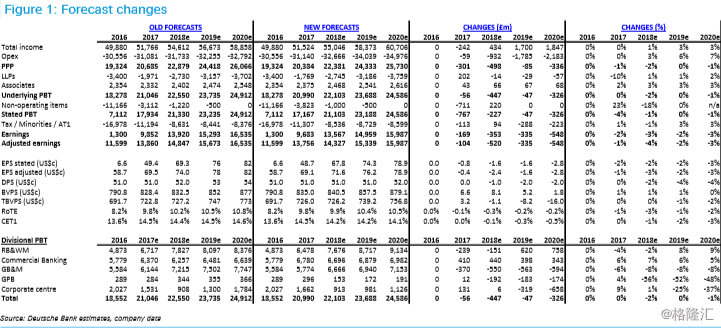

Shares in HSBC have been weaker since results, in part reflecting a moderation of market expectations on cost jaws. Management have reiterated their 1-2% guidance over the year and stressed that they are unlikely to want to operate outside of this range - preferring instead to invest in the business and in growth opportunities to drive the strategy forward. HSBC indeed remains geared to growth (targeting mid-single digit loan expansion), interest rate normalisation (100bps rise across all currency blocks is worth US$3.3bn in revenue in year 1, US$4.4bn in year 2) and provides a stable dividend yield of 5.3% (3.7% net of scrip) with potential for buybacks. But trading at 12.7x 2019e EPS it is not cheap vs. European (10.2x) or HK banks (12.4x) and we see the shares as fairly priced for the growth outlook at present. Our forecast changes are shown in Figure 1 we have reduced forecasts by 2-4% for 2018-20e (with cost jaws now 1.2-1.9%). Our TP falls to 76HKD. Given proximity to current share price we retain our Hold rating. Updated list of questions for management included overleaf.

Next catalyst: Asia update + strategy refresh from new CEO

The next catalysts for HSBC primarily focus on what strategic direction the new management (Chairman Tucker, CEO Flint) decide to take the firm in. We expect new content as part of its investor trip to Hong Kong / China in April, and on the call new CEO Flint said he would update the market on strategy either at or before 1H18 results at beginning of August. At this stage we suspect evolution rather than a revolution: the post-crisis heavy lifting on legacy assets, country exits and GBM rationalisation has completed; costs are far better controlled, and growth returned to the business in 2017. Where we expect focus to rest is on the specific areas of growth and investment targeted over the coming 3-4 years: with particular attention likely on insurance in Asia, the US business (where returns remain poor) and Europe (transitioning to a post-Brexit structure). We also expect the issue of capital return will need to be addressed by management given a CET1 which remains well above even an elevated capital requirement.

Target price to 76HKD, retain Hold

Our DDM & SoTP derivated TP falls to 76HKD on EPS changes. Key upside risks are higher US rates, an improvement in Emerging Markets outlook, lower-thanexpected loan losses, better-than-expected outcomes for regulation, lower costs, and better than expected distributions / buybacks, weaker sterling. Key downside risks relate to regulatory change, legacy liabilities, slowdown in EM, sustained low interest rate environment, cost inflation, and stronger sterling.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员