机构:中信建投

评级:buy

目标价:3港币

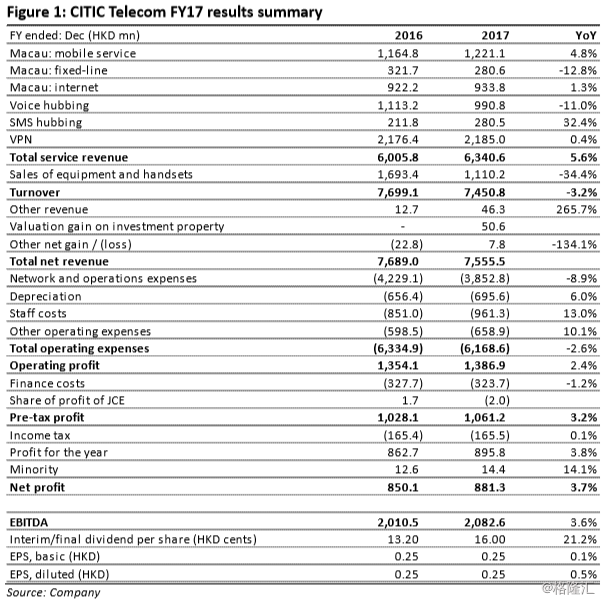

Positive readings from a solid set of FY17 results. Though a bit behind our estimates in bottom-line, CITIC Tel’s FY17 key headlines indicate a healthy momentum in the company’s strategy, expanding its global reach in data network coverage through acquisition and seeking new revenue streams through innovation. Service revenue grew 5.6% YoY, driven by mobile data (4G subs penetration at 89%), continued solid growth of VPN in China and the inclusion of Acclivis’ full-year results and CPC Europe since acquisition, which more than offset decline in Macau fixed-line and leased line (tariff reduction). Encouragingly, revenue from ‘DataMall’ surged 326.4% YoY to HKD69.5mn, reversing four consecutive years of decline in hubbing (primarily voice hubbing) revenue.

Sustainable dividend payout, still financial leeway for acquisitions. As of end-2017, the company’s net gearing had retreated to 73.7 and will continue to decrease to 51.2% in FY20E in our estimates. On the back of declining debts and finance costs, CITIC Tel was able to maintain a steady increase in dividend payout (64% dividend payout ratio for FY17). Fulfilling its commitment in dividend, the company still has financial leeway for potential acquisitions in our view, in particularly over the coming two years during which we should see a gradual decline in its capex before commercial deployment of 5G in 2020.

Attractive dividend yield, valuation at historical trough. We have kept our FY18/19E service revenue estimates largely unchanged, but have trimmed the respective earnings forecasts by 5.4%/6.0%, reflecting higher network operation costs from its global acquisition. Meanwhile, we have lowered our DCF-based price target to HKD3.0 (from HKD3.20), still implying 30.4% potential upside. The company trades at FY18E 9.0x PER, 0.9x PBR and 7.4% dividend yield, which is appealing given its potential long-term growth through acquisitions. Maintain Buy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员