机构:联昌证券

评级:增持

目标价:13.5港元

1HFY18 core profit likely fell due to no project completion

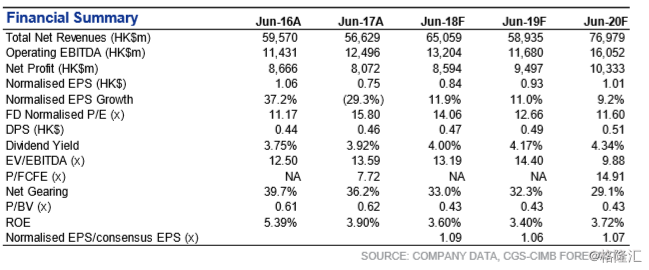

NWD will announce its 1HFY18 (Jul-Dec 17) results on 27 Feb. We estimate its core profit fell 14% yoy to HK$3.6bn, mainly due to no project completions in HK in 1H. However, we remain confident that FY18F core profit will grow 11% upon the completion of Pavilia Bay in 2HFY18. We expect it to announce 1H DPS of HK$0.13.

Plenty of saleable resources for CY18

We estimate NWD’s contracted sales in 1HFY18 amounted to HK$4bn, -15% yoy, mainly contributed by Mount Pavilia (HK$1.5bn), The Parkville (HK$776m) and Artisan House (HK$679m). We expect NWD’s FY18 contracted sales to be ~HK$10bn. NWD plans to launch three projects in CY18, namely Fleur Pavilia (611 units), second phase of Mount Pavilia (200 units) and Sheung Heung Road project (300 units). We estimate the total sales value to be HK$11bn.

Property sales recognition likely slowed in 1HFY18

NWD had no project completions in 1HFY18; as such, we estimate recognised sales declined by 47% to HK$3bn in 1HFY18, mainly contributed by inventory sales of Mount Pavilia and Double Cove. EBIT margin likely fell 2% pts yoy to 26% in 1HFY18, mainly due to a change in property sales mix.

Pre-leasing of Victoria Dockside may surprise the market K11

Atelier, the office portion of Victoria Dockside, has been handed over to tenants since 1HFY18. We expect the occupancy to reach 90% by end-FY18. According to HKET, the headline rent in Kowloon reached a record-high level of HK$95/sf/month, exceeding SHKP’s ICC. The retail mall is scheduled to open in 1HFY19. We expect preleasing progress will speed up along with the recovering retail market. We expect the entire project can double NWD’s full-year rental income in FY20F.

China sales to accelerate in 2HFY18

According to CRIC data, NWD recorded Rmb6bn contracted sales in 1HFY18, accounting for 40% of its FY18F sales target of Rmb16bn. 1HFY18 sales were impacted by policy tightening during the Communist Party Congress in Oct 17. We believe the fullyear target is still achievable. Besides, NWD has 2.2m sq m of non-core projects which it can dispose. We believe these projects will eventually be taken up by Chinese developers as market consolidation continues.

Reiterate Add with an unchanged TP of HK$13.5

The re-rating of NWD’s share price has accelerated since third generation Adrian Cheng took on more responsibility in FY17. We expect the re-rating to continue as many of its restructuring initiatives start to bear fruit in FY19-20F – an increase in its China sales in FY19 after it streamlined its landbank and full-year contribution of Victoria Dockside in FY20F. Our TP of HK$13.5 is based on a 40% discount to NAV. Maintain Add. Key risks include delays in the opening of Victoria Dockside and a slowdown in the local economy.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员