机构:招商证券

评级:中性

目标价:4.39港元

3Q18 below on weaker mobile and margin miss

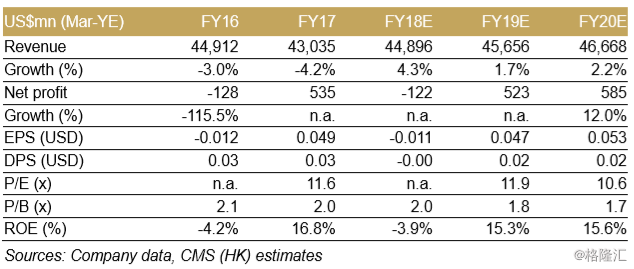

Lenovo reported 3Q18 revenue of US$12.9bn (+10% QoQ, +6% YoY), mainly driven by solid PC/ datacenter (+8%/+17% YoY), while mobile segment remained weak with 5% YoY sales decline. Gross margin came in at 13.5%, below our estimates/ consensus of 13.8%/14.3%, and PTI of US$150 was 18%/27% below our estimates/ consensus on continued loss in mobile and datacenter businesses. We fine-tuned FY18E-20E EPS to reflect better PC/ datacenter sales but slower-than-expected mobile/ datacentre turnaround under intensified competition.

PC momentum held up well but mobile turnaround still distant Lenovo’s PCSD segment recorded solid growth of 8% YoY/10% QoQ, driven by commercial refresh cycle and better product mix in consumer segment. PTI margin stayed largely flattish at 4.5% due to better ASP offsetting higher component costs. For datacenter (DCG), 3Q18 revenue grew 17% YoY/ 26% QoQ, driven by early success of restructuring to boost sales in hyperscale server, high-performance PC and softwaredefined server. PTI margin improved to -7% in 3Q, vs. 13%/15% in 2Q/ 1Q. For mobile (MBG), revenue declined 5% YoY in 3Q, due to lack of attractive products and emerging market weakness. PTI margin remained weak at -6%, vs -8%/-10% in 2Q/1Q. Looking ahead, we believe PC biz will remain solid with stable margins, while datacenter loss will narrow gradually with stronger product offerings and sales strategy. However, we remain cautious on profitability of mobile biz given lack of scale and intensified competition in both China/emerging markets.

Uncertainties in turnaround, maintain NEUTRAL The stock is now trading at 11.9x FY19E P/E, and we maintain our Neutral rating with new TP of HK$4.1 based on 11.0x FY19E P/E (4-yr historical mean). We recommend investors to stay on the sidelines until seeing more signs of mobile shipment recovery and profitability improvement. Downside risks include slower PC demand, higher mobile loss, and slower than expected enterprise growth.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员