机构:中金公司

评级:买入

目标价:40.31 港元

Be well prepared for a bottoming-out of sales growth in 2018. Sales of HK$300bn (YoY +29%) should be easily generated from sale able resources as abundant as HK$450–500bn, after a fruitful 2017 with17.4mn m2of land replenishment and 19mn m2of GFA new starts.Strong growth in January (est. >20% YoY) despite a high base should trigger an upward consensus revision, and the growth will further improve in 2H18e due to a lower base. Therefore, we think COLI will not fall behind peers any more in 2018.

Lucrative margins to uplift earnings delivery. Booked GPM is estimated to be 30.2%/30.1%/30.7% in FY17/18/19, thanks to sales GPM being consistently above 30% in 2016/17.

Strong balance sheet to lay a firm foundation for scale expansion.Net gearing ratio was well capped below 40% at end-FY17 (21.2% atend-3Q17). Combined with ambitious sales in 2018e, COLI should be comfortable with mildly quickening expansion. Its sector-leading capacity for fund raising―average financing cost as low as 4.2% in1H17―will secure the land purchases.

Valuation and recommendation

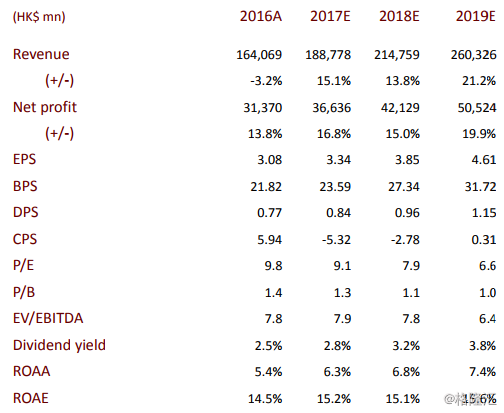

Maintain FY17e core NP of HK$36.6bn (YoY +17%); trim FY18e coreNP slightly by 4.6% to HK$42.1bn (YoY +15%) and introduce FY19e ofHK$50.5bn (YoY +20%) for delivery adjustment. Reaffirm as sector toppick and hold TP at HK$40.31 (33% upside). We regard COLI as aquality laggard with visible & better-than-expected sales,defensiveness, and more importantly, an attractive valuation. COLItrades at 7.9x FY18e and 6.6x FY19e P/E (below its average of the pastseven years), on par with small caps like Agile and CIFI.

Risks

2018e sales fall short of expectations.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员