机构:招商证券

评级:BUY

Company made satisfactory delivery in 4Q2017

Company reported 9%/33% growth in 2017 revenue and shareholder’s attributable net profit, all in RMB terms. The net profit was 6% behind consensus but in line with our estimate. 4Q17 saw the backsliding in Ganmei (down 3%) and Runzhong (flat), but had quickening sales in Tuotuo, Kaifen and Zepusi.

Numerous growth drivers in 2018

We believe SBP has above average growth visibility in 2018. This should thank to the launches of Anlotinib and Tenofovir - Mgmt estimates that Anlotinib should fetch RMB500-600m sales and Tenfovir RMB300-400m sales in 12m after launch. In addition, we estimate 31% of FY17 revenue should benefit from the BE results (TDF, Entecavir) and NRDL inclusion (Zepusi, Qingweike, Yinishu, Genike and Zhiruo). Some of the existing products, Kaifen and Aisuping, should also see c.30-60% sales growth on strong demand. Lastly, the consolidation of Taide would contribute to net profit growth (but EPS neutral in our view). Such growth should well offset 4% fall in sales in Runzhong and 15% fall in Kaishi in 2018, in our view.

TP upgraded on numerous R&D catalysts

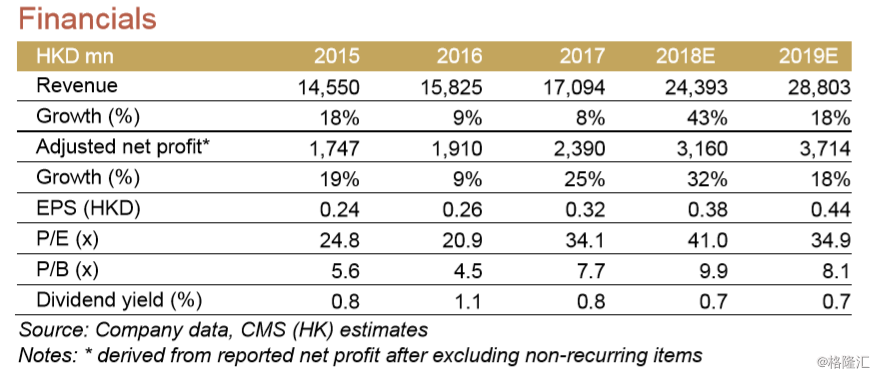

We increased 2018/19E EPS estimates by 4%/7% to reflect the accelerating growth. We revised up the TP by 21%, mainly as we apply higher NOPAT multiples for its generic portfolio as we now expect 4-5 new products launches each year from 2018, versus 2-3 in 2016-18. This assumption is well supported by its industry leading generic pipeline, in our view. The candidates for new approvals are: Anlotinib (end of 1Q18E), Factor VIII(19E), Ganirelix (18E), Forsaprepitant (18E), Bortizomib(18E), Lenalidomide (19E), Gefitinib (19E) and Pantoprazole (18E/19E), etc. We maintained 30% M&A premium on SOTP valuation.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员