机构:交银国际

评级:BUY

目标价:535港元

Top line missed on game revenue; bottom line beat on lower G&A expenses. Total revenue was RMB66.4bn, up 51% YoY/ 2% QoQ but 3% lower than our estimate. Non-GAAP diluted EPS was RMB1.83, beating our estimate by 10%. Non-GAAP net profit margin was 26%, flat QoQ/ down 2ppts YoY.

Digital content platforms led; games under seasonal pressure; advertising supported by Weixin platform. Game revenue was down 9% QoQ, due to seasonality of PC games, the timing of new games releases, and user time shifting from existing games to new PUBG mobile games, while the latter has not started monetization. The broadcast of hot drama series and self-produced content on Tencent Video (DAU: 137m, subscribers: 62m) drove the growth in media ad and subscription revenue. The growth of social ad was driven by increased ad impression in Weixin Moments and Official Accounts, considering higher ad demand benefiting from enhanced ad targeting capability. Offline payment transaction volume more than doubled YoY.

2018 outlook: In our view, the lack of monetization of PUBG games and relatively stable performance of Honor of Kings may not contribute much incremental revenue in 2018, while the mobile versions of hot IP games, i.e. QQ Speed (DAU: 20m) and JX series, may provide additional revenue. Moreover, we believe the 170m miniprogram DAU and various Weixin ads will be the major driver for ad revenue. Offering retail solutions to supermarkets, FMCG and department stores leveraging big data and sale channels, will in turn drive the growth of payment, in our view.

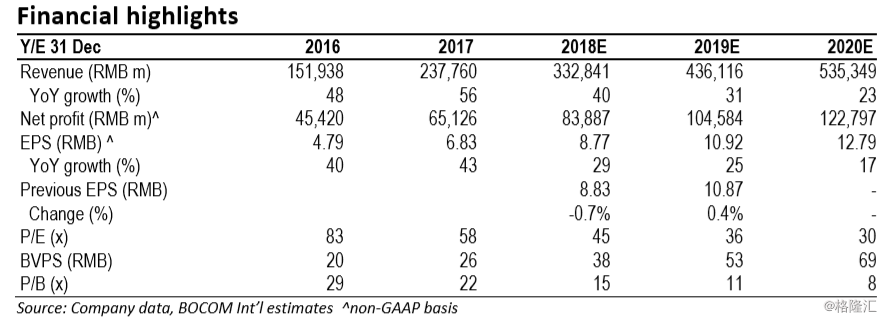

Valuation. Given the continuous investment in video content, innovated business model, as well as payment, we expect the margin will see 2-3ppt decrease from 2017 for the coming years. Although the pressure exists, we are positive on Tencent’s continuous monetization on its leading platforms and new initiatives, i.e. cloud, financial services (RMB300bn AUM/ RMB 100bn loans), and new retail ecosystem. Maintain Buy and TP at HK$535, implying 53x/42x 2018/19E P/E.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员