评级:BUY

目标价:1.85港元

2017 results miss expectations

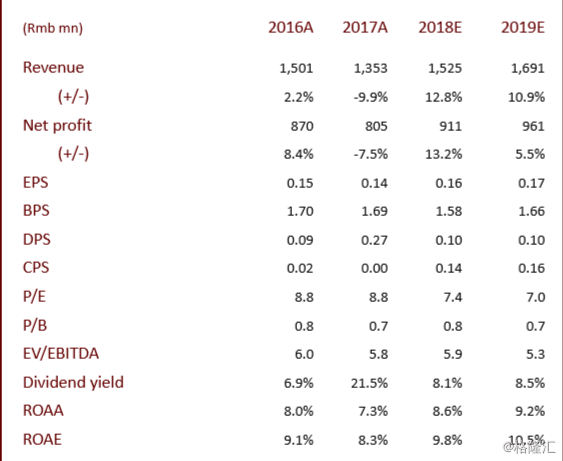

China Dongxiang announced 2017 results: Revenue fell 9.9% to Rmb1,353mn; net profit fell 7.5% to Rmb805mn or Rmb0.14/share. The results missed expectations. The apparel business posted a net loss of around Rmb17mn (vs. a profit of around Rmb196mn in 2016). The firm proposed to pay a total 2017 DPS of Rmb0.27 (including interim, final and special payments) for a payout ratio of 189%.

Sales in China fell 8.3% to Rmb1,037mn, as retail sales value (RSV) and same store sales fell by mid and low single-digit percentages, respectively, though retail performance improved in 2H17. Online RSV fell by a low single-digit percentage, while kidswear sales jumped 32.6% to Rmb114mn. As of end-2017, the number of Kappa retail and kids stores totaled 1,137 and 350 (down 12.6% and up 33.6%, respectively). Sales in Japan fell 15% to Rmb316mn. Financial overview: Gross margin slipped 1.2ppt to 55.7%, net investment income jumped 23.9% to Rmb876mn, and SG&A expense ratio rose 7.6ppt to 50.7% on a 26.5% increase in A&P costs

Trends to watch

In the apparel business, management expects mid to high single-digit growth in same-store efficiency and low double-digit RSV growth in 2018. It intends to attach more importance to footwear products and said store renovations and relocations are planned.

Valuation and recommendation

The stock is trading at 7.4x 2018e and 7.0x 2019e P/E. We maintain BUY but lower our target price by 15% to HK$1.85 (23.2% upside) to reflect adjustments in our SOTP valuation. We assign a 10% multi-business discount to the sum of the firm’s segments and value the apparel business at 14x 2019e P/E. The apparel business targets niche sportswear segments and should turn around in the next few years. We expect robust growth from the investment business.

Risks

Consumption could slow further; apparel trends could disappoint.

下载格隆汇APP

下载格隆汇APP

下载诊股宝App

下载诊股宝App

下载汇路演APP

下载汇路演APP

社区

社区

会员

会员